1

A Subsidiary of AXIS BANK

CONTENTS

Board of Directors 2

Directors’ Report 3

Auditors’ Report 37

Balance Sheet 46

Statement of Profit and Loss Account 48

Cash Flow Statement 50

Notes to Accounts 52

2

A Subsidiary of AXIS BANK

BOARD OF DIRECTORS

Pralay Mondal Chairman

Gop Kumar Bhaskaran Managing Director & CEO

Anand Kumar Shaha Whole Time Director

Ramesh Kumar Bammi Director

(Resigned w.e.f. 27.04.2020)

Jagdeep Mallareddy Director

(Resigned w.e.f. 19.05.2020)

Babu Rao Busi Independent Director

Bhumika Batra Independent Director

Divya Poojari (Ms.) Company Secretary

Hemantkumar Patel Chief Financial Officer

M/s. S.R. Batliboi & Co. LLP STATUTORY AUDITORS

Chartered Accountants

M/s. RVA & Associates LLP INTERNAL AUDITORS

Chartered Accountants

M/s. BNP & Associates SECRETARIAL AUDITORS

Practising Company Secretaries

KFintech Private Limited REGISTRAR AND SHARE TRANSFER AGENT

Karvy Selenium, Tower-B, Plot No 31& 32,

Gachibowli, Financial District,

Nanakramguda, Serilingampally,

Hyderabad - 500 008, India

Tel. : +91 040 67161604

REGISTERED OFFICE

Axis House, 8

th

Floor, Wadia International Centre,

Pandurang Budhkar Marg, Worli, Mumbai – 400 025

CIN : U74992MH2006PLC163204

Tel. : 022 2425 2009

Email : [email protected]

Website : www.axisdirect.in / www.axissecurities.in

CORPORATE OFFICE

Phoenix Market City, Unit No. 2, 2nd Floor, 15, LBS Road,

Near Kamani Junction, Kurla (West), Mumbai – 400 070

Tel. : 022 42671500

3

A Subsidiary of AXIS BANK

DIRECTORS’ REPORT

DEAR MEMBERS

Your Directors have pleasure in presenting the 14

th

Annual Report of Axis Securities Limited (the

Company) alongwith the Audited Financial Statements for the financial year ended March 31,

2020.

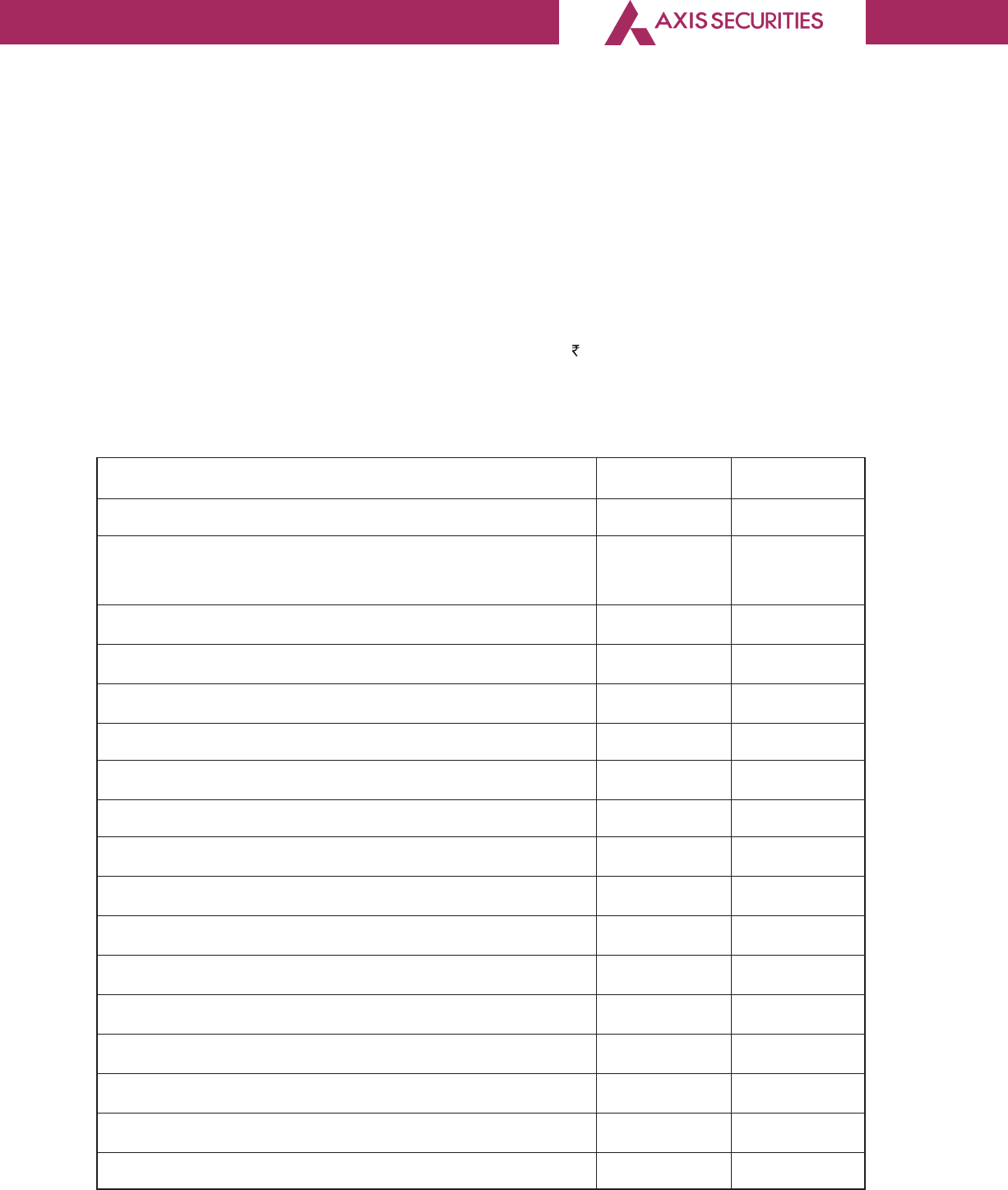

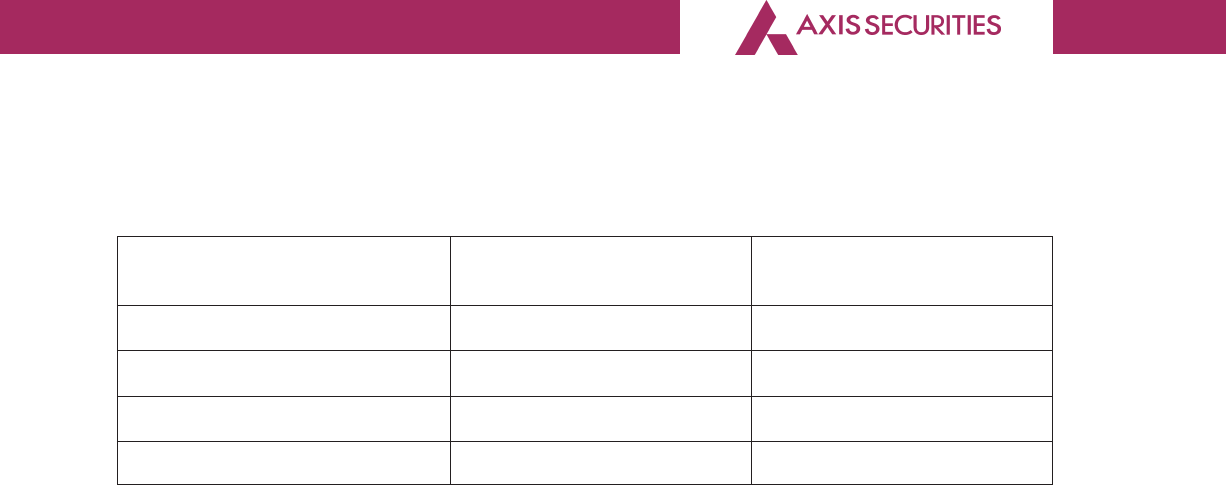

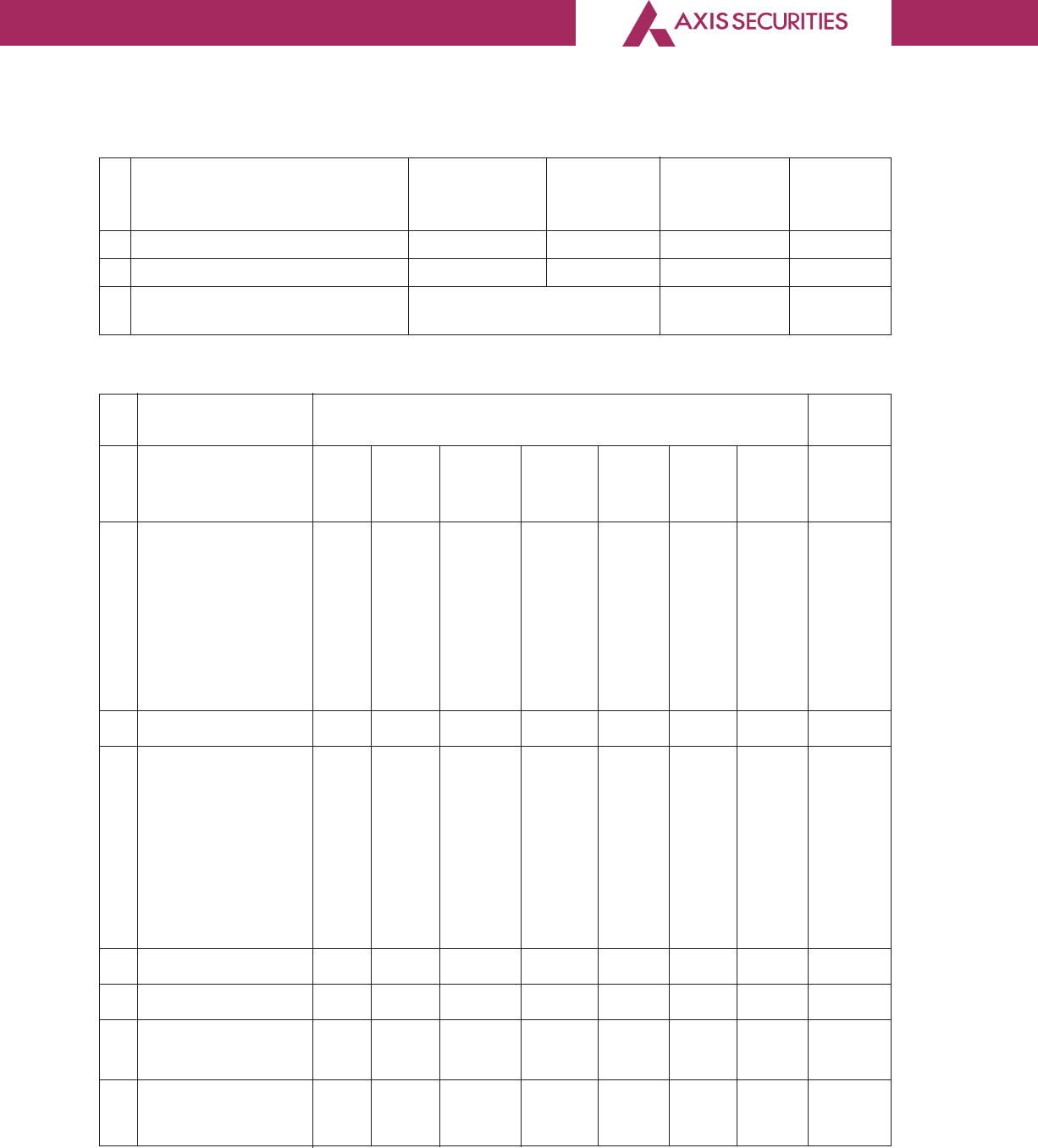

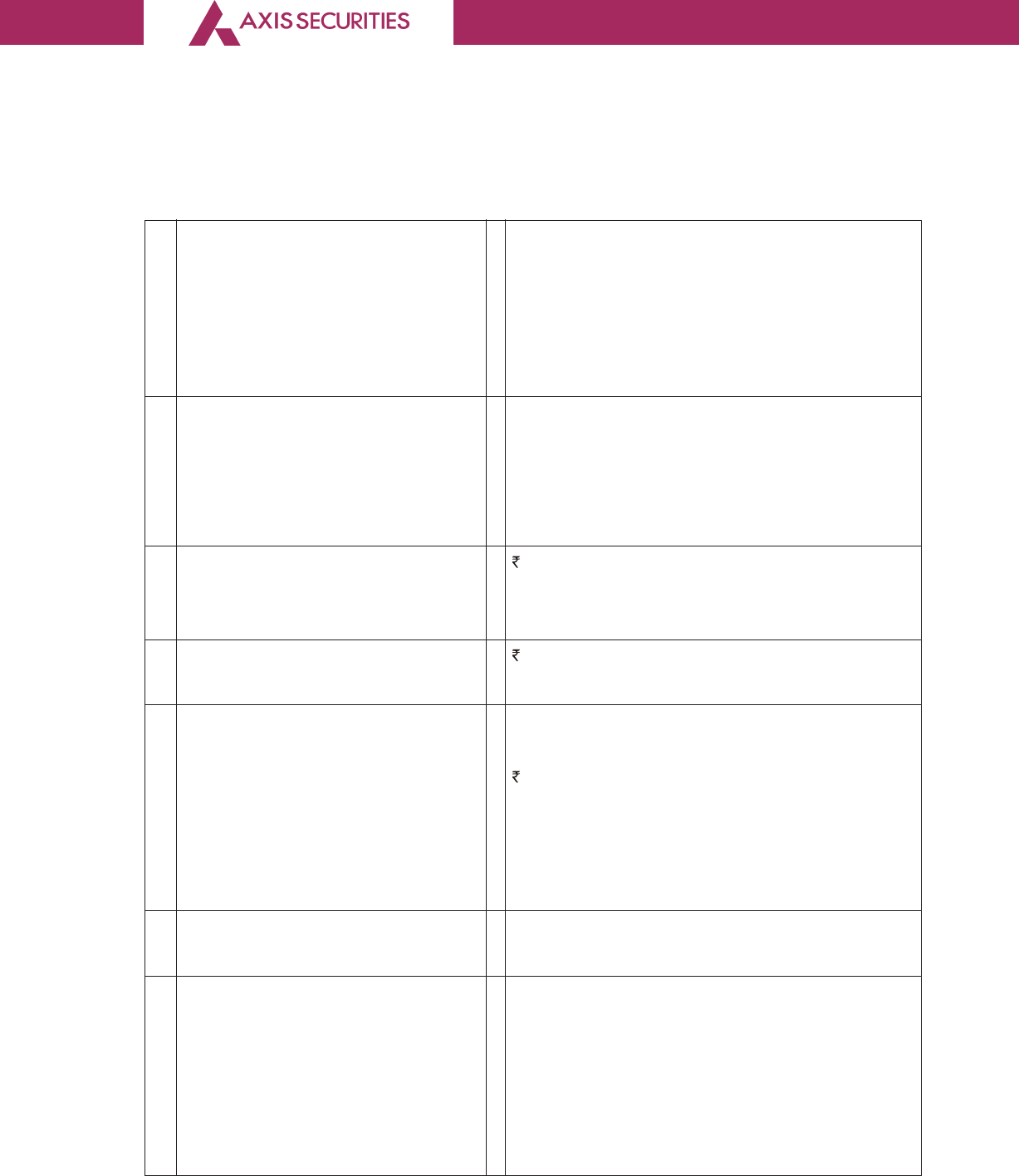

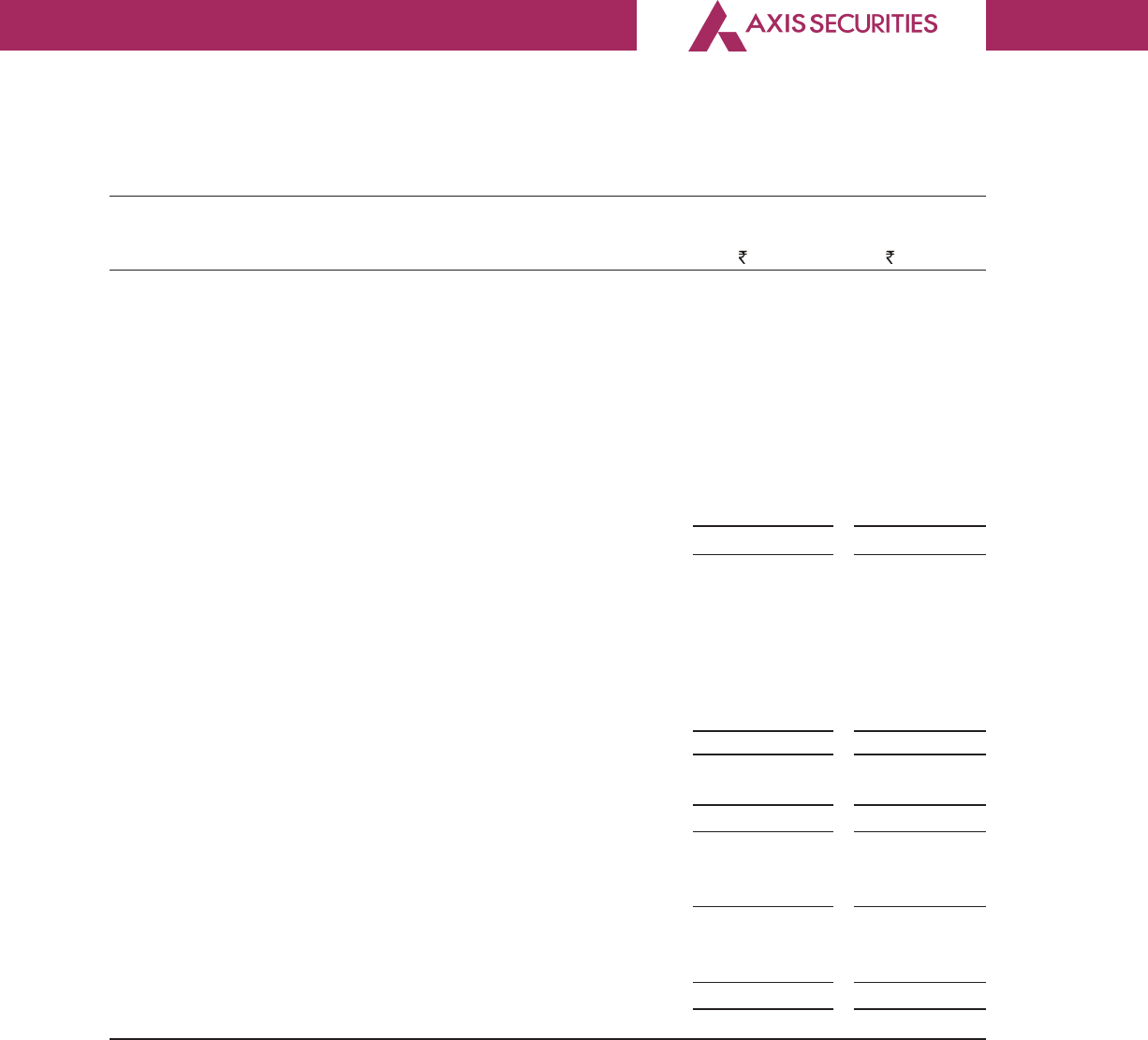

FINANCIAL PERFORMANCE:-

During the year, the Company achieved a total income of 2,377,238,793/-

The highlights of the financial Results of your Company for the year ended March 31, 2020 are

given below:

(Figures in Lakhs)

Particulars 2019-20 2018-19

Operating Income(A) 19,589 19,028

Interest Income on Fixed Deposits and Miscellaneous

Income (B) 1,329 816

Total Income (A)+(B) 20,918 19,844

Operating Expenses 11,991 14,230

Profit/(Loss) before Depreciation & provisions for tax 8,927 5,614

Depreciation 1,438 1,063

Provision for Tax 2,228 1,624

Profit for the year from continuing operation 5,261 2,927

Exceptional items (2,845) –

Profit before tax for the year from discontinued

Profit before tax for the year from discontinued operations 665 6,693

Tax income/ (expense) of discontinued operations 183 2,408

Deferred tax – 50

Profit for the year from discontinued operations 482 4,335

Profit for the year 2,898 7,262

Other Comprehensive Income (164) 189

Total Comprehensive Income for the year 2,734 7,451

4

A Subsidiary of AXIS BANK

BUSINESS OVERVIEW & REVIEW OF OPERATIONS:-

In Financial Year 2019-20 Retail Broking has achieved overall revenue of Rs. 20918 lakhs which is

increase of 5% as compared to Rs. 19844 lakhs in Financial Year 2018-19 and have acquired 1.77

Lakhs customers.

GENERAL RESERVE:-

The Company in accordance with Section 123 of the Companies Act, 2013 (“the Act”), has

transferred a sum of Rs. 1,59,00,000/- to the General Reserve account.

MATERIAL CHANGE AND COMMITMENT:-

In terms of the information required under sub-section (3)(l) of Section 134 of the Act, it is to be

noted that no material changes and commitments, affecting the financial position of the Company

has occurred between the end of the Financial Year of the Company to which the Financial

Statements relate and to the date of the Directors Report.

ANNUAL RETURN:-

The Annual Return of the Company for the said financial year as required under Section 92 of the

Companies (Amendment) Act, 2017 is available on the website of the Company at https://

simplehai.axisdirect.in/aboutus and the same is enclosed as Annexure-A

DETAILS OF SIGNIFICANT AND MATERIAL ORDERS PASSED BY THE REGULATORS OR COURTS OR

TRIBUNALS IMPACTING THE GOING CONCERN STATUS AND COMPANY’S OPERATIONS IN FUTURE:-

In terms of the information required under Section – 134 of the Act and Clause – 8 of the Companies

(Accounts) Rules, 2014 it is to be noted that there is no significant and material order passed by the

Regulators or Courts or Tribunals impacting the going concern status and Company’s operations

in future.

STATEMENT INDICATING DEVELOPMENT AND IMPLEMENTATION OF A RISK MANAGEMENT POLICY

INCLUDING IDENTIFICATION THEREIN OF ELEMENTS OF RISK:-

Risk Management is a key function in a Stock Broking Company. Real-time monitoring of overall

exposure of the Company is required from the point of view of Risk Control. In volatile markets,

robust Risk Management policies are must.

The Company has adopted a comprehensive Risk Management Policy identifying various elements

of risks, risk parameters and risk containment measures. The Company has automated risk

5

A Subsidiary of AXIS BANK

management systems in place. The risk system monitors various trades and positions of the clients

on real-time basis with the help of real time data feeds from Exchanges. The system also generates

automated alerts in case of specified events based on the set parameters. A dedicated risk team

monitoring the risk systems acts promptly on such alerts. The above risk processes have been put in

place for Equities, Derivatives, Commodities and Currencies etc.

Client defaults in paying up the losses arising out of client positions poses significant risk, which in

the opinion of the Board may threaten the existence of the Company. Other identified risks are

system malfunction, black swan event, Internal as well as external frauds, adverse regulatory action

against the Company etc.

INTERNAL CONTROL SYSTEMS AND THEIR ADEQUACY:-

The Company has an Internal Control System commensurate with the size, scale and complexityof

its operations. Internal control systems comprising of policies and procedures are designed to ensure

reliability of financial reporting, timely feedback on achievement of operational and strategic

goals, compliance with policies, procedure, applicable laws and regulations and that all assets

and resources are acquired economically, used efficiently and protected adequately.

The Internal Audit Department monitors and evaluates the efficacy and adequacy of internal

control system in the Company, its compliance with operating systems, accounting procedures

and policies at all locations of the Company. Based on the report of internal audit function, process

owners undertake corrective action in their respective areas and thereby strengthen the controls.

Significant audit observations and corrective actions thereon are presented to the Audit Committee

of the Board. A yearly presentation on Internal Financial Control Systems is also presented to Audit

Committee of the Board.

VIGIL MECHANISM / WHISTLE BLOWER POLICY:-

The Company has adopted the code of conduct for employee, customers, vendors and also for

its directors for the highest degree of transparency, integrity, accountability and corporate social

responsibility. Any actual or potential violation of the Code would be a matter of serious concern

for the Company.

The Company has also in place a Whistleblower Policy (‘the Policy’) which aims to set up a

mechanism that enables employees to report about actual or potential illegal and/or

unacceptable practices. The policy is designed to enable employees, to raise concerns to

Whistleblower Committee, without revealing his/her identity, if he/she chooses to do so and to

disclose information which the individual believes, shows malpractice or wrongdoing which could

affect the business or reputation of the Company.

6

A Subsidiary of AXIS BANK

The Policy is to provide framework for an effective vigil mechanism and to provide protection to

employees, customers, vendors or directors reporting genuine concerns.

Employees of the Company are encouraged to use guidance provided in the Policy for reporting

all allegations of suspected improper activities to the Whistle Blower Committee by sending the

members an email on [email protected]

BOARD OF DIRECTORS, MEETINGS, EVALUATION ETC.:-

Board of Directors:-

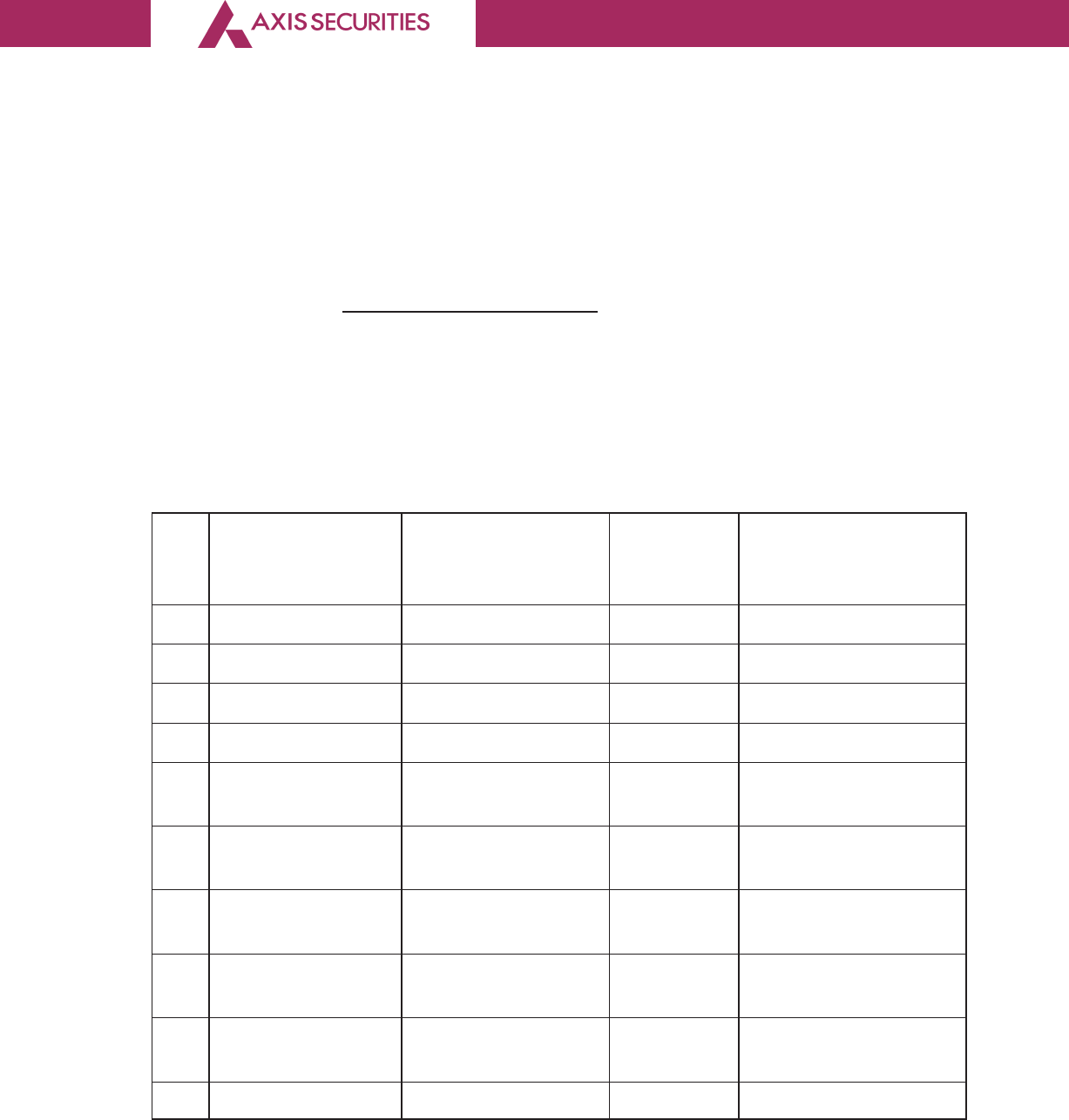

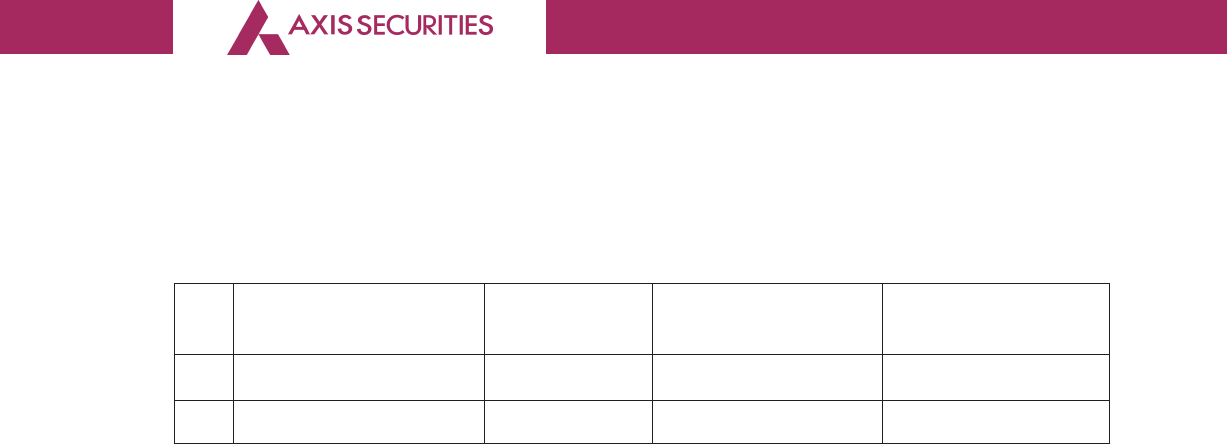

During the year under review, following are the list of Directors being appointed or resigned from

the Board of the Company:

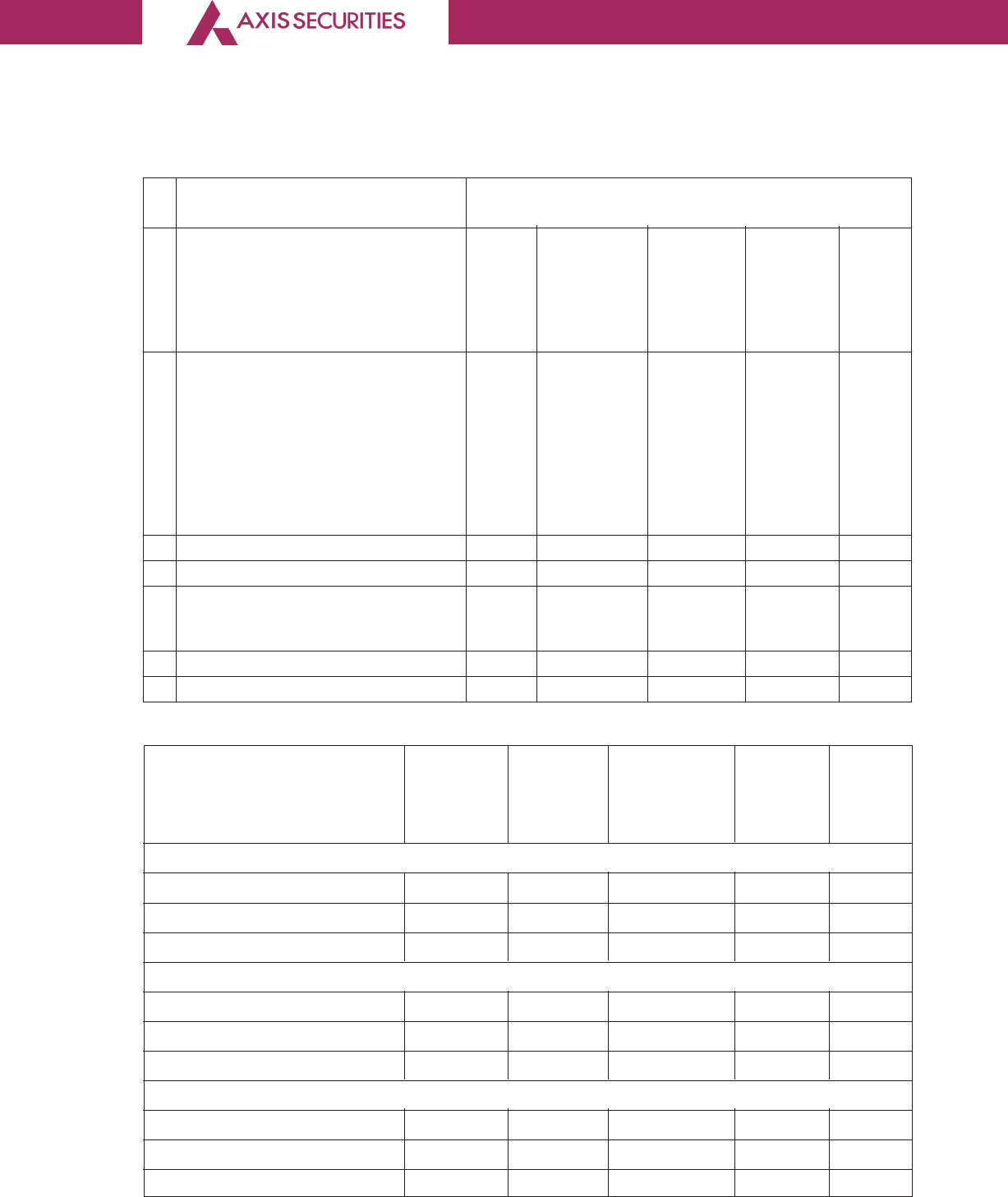

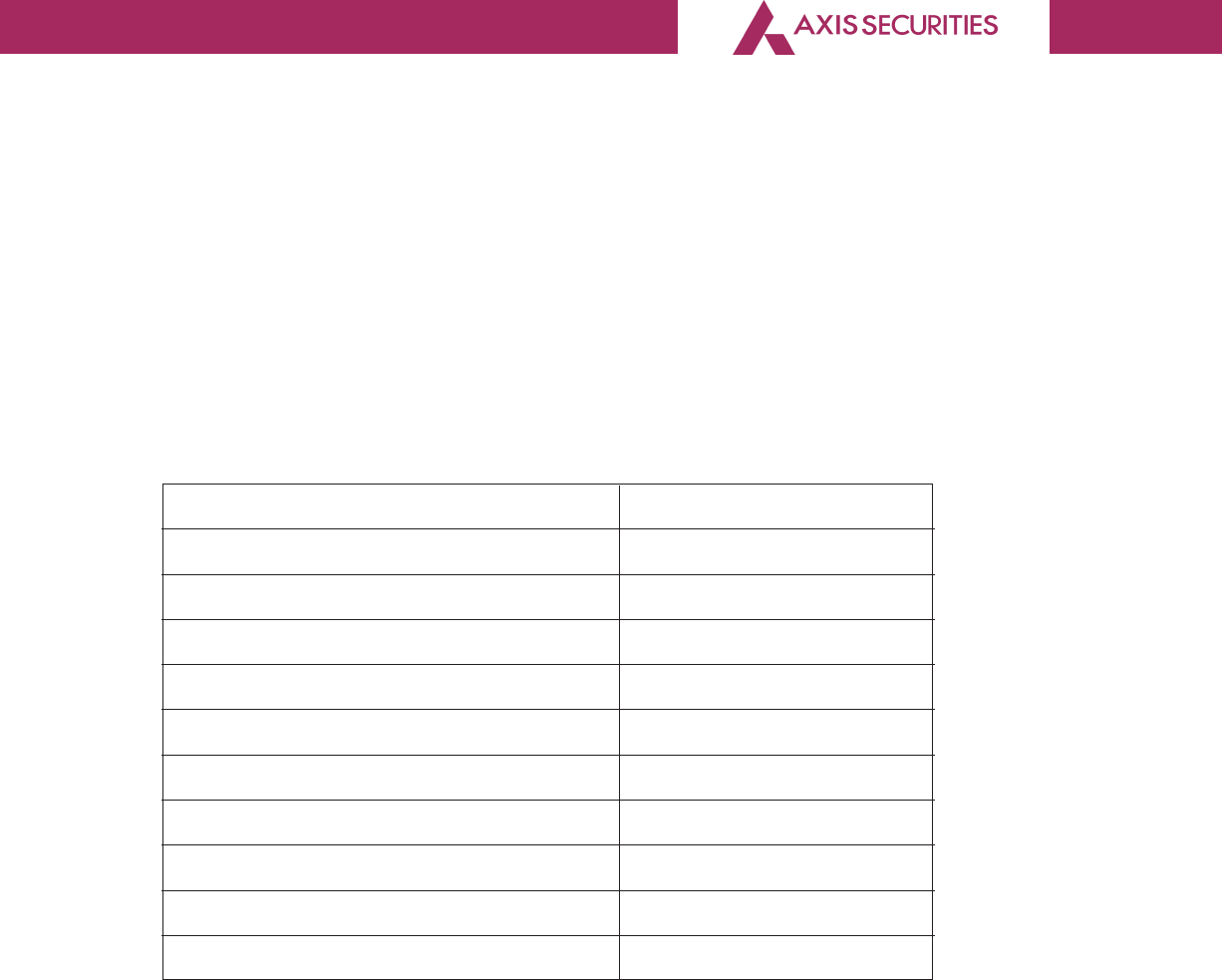

Sr. Name of the Status Date of Designation

No. Director appointment/

Resignation

1 Ms. Nithya Easwaran Resignation 12.04.2019 Independent Director

2 Mr. Pralay Mondal Appointment 12.04.2019 Additional Director

3. Mr. Rajiv Anand Resignation 09.05.2019 Director

4. Mr. Pralay Mondal Change in Designation 07.06.2019 Director

5. Ms. Bhumika Batra Appointment 23.07.2019 Additional Independent

Director

6. Mr. Gop Kumar

Bhaskaran Appointment 18.10.2019 Additional Director

7. Mr. Arun Thukral Resignation 31.12.2019 Managing Director

& CEO

8. Mr. Gop Kumar Change in 08.01.2020 Director

Bhaskaran Designation

9. Mr. Gop Kumar Appointment 01.01.2020 Managing Director

Bhaskaran & CEO

10. Ms. Bhumika Batra Change in Designation 08.01.2020 Independent Director

Board Meetings:-

During the year under review, the Board of Directors (hereinafter called as the “BOARD”) met for

five times viz. 12.04.2019, 16.07.2019, 24.09.2019, 18.10.2019 and 15.01.2020:

7

A Subsidiary of AXIS BANK

The details of the attendance of the Board are as follows:

Name of the Director Number of Board Number of Meetings

Meetings Entitled to Attend Attended

Mr. Rajiv Anand 1 1

Mr. Pralay Mondal 4 4

Mr. Ramesh Kumar Bammi 5 4

Mr. Babu Rao Busi 5 5

Ms. Nithiya Easwaran 1 1

Ms. Bhumika Batra 3 3

Mr. Jagdeep Mallareddy 5 4

Mr. Arun Thukral 4 4

Mr. Anand Kumar Saha 5 4

Mr. Gop Kumar Bhaskaran 1 1

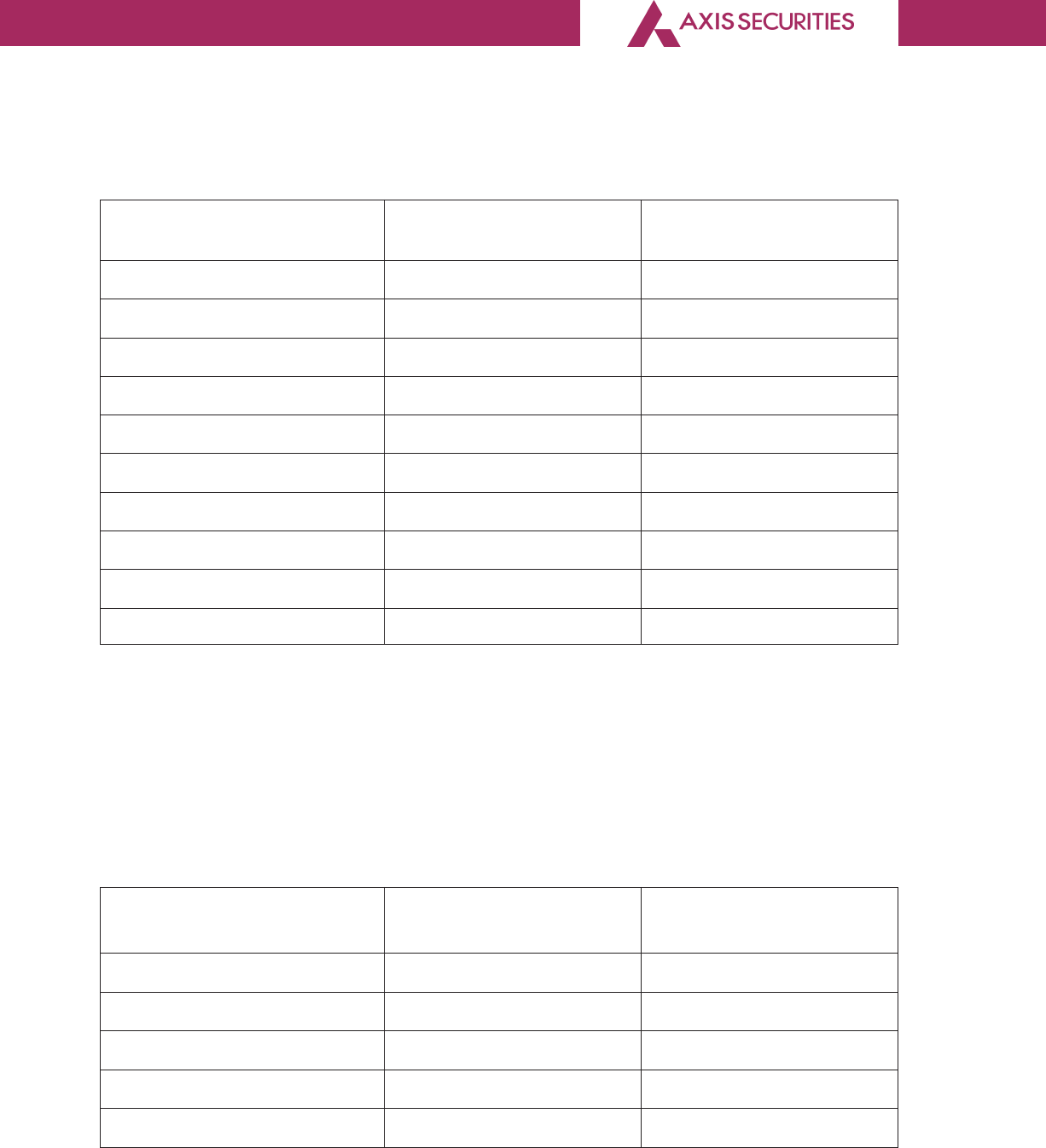

COMMITTEES OF THE BOARD

I. AUDIT COMMITTEE

During the year under review, the Audit Committee met four times viz: 12.04.2019, 16.07.2019,

18.10.2019 and 15.01.2020

The details of the attendance of the Audit Committee Members are as follows:

Name of the Director Number of Board Number of Meetings

Meetings Entitled to Attend Attended

Ms. Nithiya Easwaran 1 1

Mr. Babu Rao Busi 4 4

Ms. Bhumika Batra 2 2

Mr. Jagdeep Mallareddy 4 3

Mr. Anand Shaha 1 0

8

A Subsidiary of AXIS BANK

II. NOMINATION AND REMUNERATION COMMITTEE (NRC)

During the year under review, the Nomination and Remuneration Committee met thrice viz:

12.04.2019, 18.10.2019 and 15.01.2020.

The details of the attendance of the NRC Members are as follows:

Name of the Member Number of Nomination Number of Meetings

and Remuneration Attended

Committee Meetings

Entitled to Attend

Mr. Babu Rao Busi 3 3

Mr. Rajiv Anand 1 1

Mr. Pralay Mondal 2 2

Ms. Nithiya Easwaran 1 1

Ms. Bhumika Batra 2 2

III. CORPORATE SOCIAL RESPONSIBILITY COMMITTEE (CSR)

During the year under review, the CSR Committee met two timesviz: 16.07.2019 and15.01.2020.

The details of the attendance of the CSR Committee Members are as follows:

Name of the Member Number of CSR Number of Meetings

Committee Meetings Attended

Entitled to Attend

Mr. Ramesh Kumar Bammi 2 2

Mr. Babu Rao Busi 1 1

Mr. Jagdeep Mallareddy 2 2

Mr. Arun Thukral 1 1

Mr. Gop Kumar Bhaskaran 1 1

IV. RISK MANAGEMENT COMMITTEE (RMC)

During the year under review, the Risk Management Committee met four times viz: 11.04.2019,

15.07.2019, 17.10.2019 and 14.01.2020.

9

A Subsidiary of AXIS BANK

The details of the attendance of the RMC Members are as follows:

Name of the Member Number of Board Meetings Number of Meetings

Entitled to Attend Attended

Mr. Jagdeep Mallareddy 4 4

Mr. Arun Thukral 3 3

Mr. Gop Kumar Bhaskaran 1 1

Mr. Anand Kumar Shaha 4 4

The intervening gap between the Meetings was within the period prescribed under the Act.

Annual Evaluation:-

The Formal Annual Evaluation has been made as follows:-

During the year under review, the Independent Directors of the Company met on March 16, 2020

without the attendance of Non-Independent Directors and Members of Management. At the

said meeting, the Independent Directors reviewed the process adopted for conduct of Board

performance evaluation as recommended by the Nomination and Remuneration Committee.

The Nomination and Remuneration Committee (the Committee) of the Company is the nodal

agency for conduct of said performance evaluation. The Committee Chairman reviewed and

approved the manner for conducting the said performance evaluation and also determined the

criteria for the same. The Committee Chairman had appointed an External Agency M/s. Potentia

Growth Services Private Limited for evaluating the performance of the Board, Committees and

Directors.

The performance evaluation of the Board was conducted on various aspects of the Board’s

functioning such as strategic planning, identification and management of risks, succession planning

and evaluation of management, audit & compliance, governance, relationship with executive

management of the Company, etc. The performance evaluation of the Committees was based

on criteria such as appropriate composition, clarity in terms of reference, regularity of meetings,

quality of discussion/deliberation at its meetings, participation of members etc. The performance

evaluation of Directors was carried out on various criteria such as attendance, participation at the

meetings, interpersonal relationship with other Directors, providing guidance, knowledge and

understanding of areas relevant to the operations of the Company, etc.

The outcomes were reviewed by the Committee and the Board in their meetings held on April 20,

2020 and April 23, 2020 and their observations/ feedback were conveyed to the concerned

stakeholders, for appropriate action.

Declaration by Independent Director:-

The Company has received the declarations from its Independent Directors that they meet the

Criteria of Independence as laid down under Section 149(6) of the Act.

10

A Subsidiary of AXIS BANK

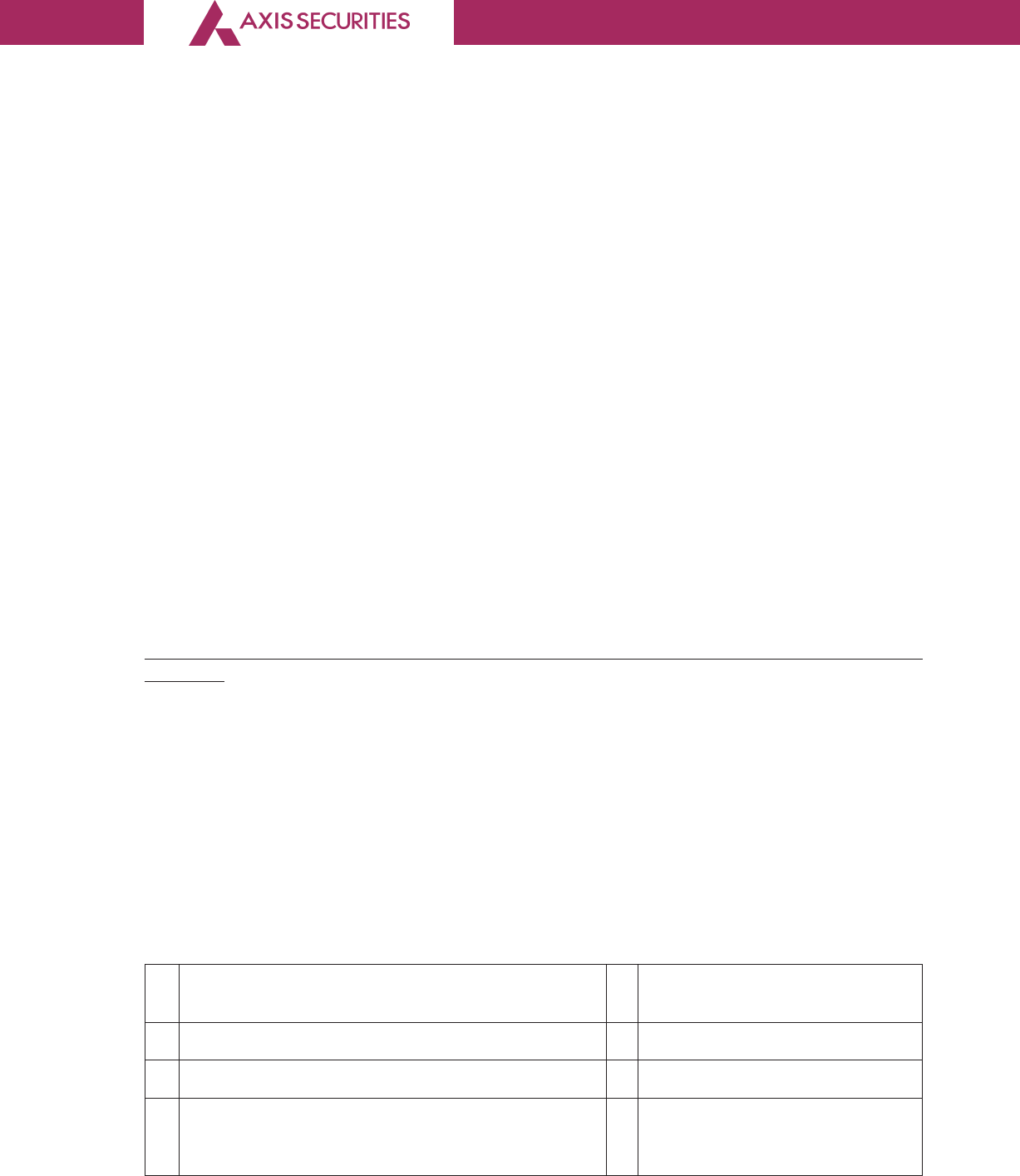

Key Managerial Personnel:-

During the year under review, following were the changes in the Key Managerial Personnel:

Sr. Name of the Key Status Date of appointment/ Designation

No. Managerial Personnel resignation

1. Ms. Lovelina Faorz Resignation 29/10/2019 Company Secretary

2. Ms. Divya Poojari Appointment 30/01/2020 Company Secretary

SHARE CAPITAL:-

During the year, the Company has increased its Authorised Capital from INR 150 crores to INR 250

crores.

Further, there is no change in the Issued, Subscribed and Paid – up Share Capital of the Company.

PUBLIC DEPOSITS:-

During the year under review, the Company has not accepted any deposit pursuant to Section 73

and Section 76 of the Act read with Companies (Acceptance of Deposits) Rules, 2014.

PARTICULARS OF CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN EXCHANGE

EARNINGS AND OUTFLOWS:-

Information as per Section 134(3)(m) of the Act relating to the Conservation of Energy and

Technology Absorption is not given since the Company is not engaged in any manufacturing

activity.

During the year under review, the Company has spent Rs. 1,493,383 (Rupees Fourteen Lakh Ninety

Three Thousand Three Hundred and Eighty Three only) in foreign exchange towards technology

and other expenses. The Company has not earned any foreign exchange. The details of the Foreign

exchange outflow are enclosed in Annexure - B.

PARTICULARS OF LOANS, GUARANTEES OR INVESTMENT UNDER SECTION- 186:-

Pursuant to Section 134(3)(g) of the Act, the Company has not given any Loan, Guarantee or

made Investment under Section 186 of the Act.

PARTICULARS OF CONTRACTS OR ARRANGEMENTS WITH RELATED PARTIES UNDER SUB – SECTION (1)

OF SECTION 188

Information as per Section 134(3)(h) of the Act relating to the particulars of Contracts or

Arrangements with Related Parties under Sub – Section (1)of Section 188 is as mentioned below:-

All Related Party Transactions that were entered into during the financial year were on arm’s length

basis and were in the ordinary course of business. There wereno materially significant Related Party

11

A Subsidiary of AXIS BANK

Transactions made by the Company with Promoters, Directors, Key Managerial Personnel or other

designated persons which may have a potential conflict with the interest of the Company at

large.

All Related Party Transactions are placed before the Audit Committee for approval. Prior omnibus

approval of the Audit Committee is obtained for the transactions which are of foreseen and

repetitive in nature. The transactions entered into pursuant to the omnibus approval so granted

are audited and a statement giving details of all Related Party Transactions are placed before the

Audit Committee.

None of the Directors has any pecuniary relationship or transactions vis-à-vis the Company. The

disclosure of particulars of contracts/arrangements entered into by the Company with related

partiespursuant to Clause (h) of sub-section (3) of Section 134 of the Act and Rule 8(2) of the

Companies (Accounts) Rules, 2014 in Form AOC – 2 is enclosed herewith as Annexure - C.

PARTICULARS OF EMPLOYEES AS REQUIRED UNDER COMPANIES ACT, 2013 AND COMPANIES

(APPOINTMENT AND REMUNERATION OF MANAGERIAL PERSONNEL) RULES, 2014:-

In terms of Section 136 of the Act, the Report and Accounts are being sent to the Members and

others entitled thereto, excluding the information on employees’ particulars. If any Member is

interested in obtaining a copy thereof, such Member may write to the Company Secretary in this

regard.

CORPORATE SOCIAL RESPONSIBILITY INITIATIVES:-

The Company recognized the importance of good corporate governance and corporate social

responsibility in promoting and strengthening the trust of its clients, employees, society and other

stakeholders. The Company’s Corporate Social Responsibility (CSR) activities reflect its philosophy

of helping to build a better, more sustainable society by taking into account the societal needs of

the Community.

The Company’s CSR Policy has been framed in accordance with Section 135 of the Companies

Act, 2013 and the rules thereunder. The policy shall apply to all CSR programs undertaken/sponsored

by the Company, executed through itself, its Holding Company’s Axis Bank Foundation or through

any other Trust/NGO.

As part of its initiatives under “Corporate SocialResponsibility” (CSR), the Company has contributed/

undertakenproject namely KABIL.

Project Kabilwas directed towards the following:

1. Improving the income of household by implementation of different rural livelihood interventions

with two indicators:

a) Participating Households would be earning at least INR 75,000 pa at project level by the

end of the project period.

2. Enhance technical knowledge of farmers in modern agriculture and allied activities;

12

A Subsidiary of AXIS BANK

3. Develop entrepreneurs from the local community for market linked livelihood development

for sustainability;

4. Access government funds to livelihood activities.

KABIL project was done through Axis Bank Foundation. The said project is in accordance with

Schedule VII of the Companies Act, 2013.

During the year under review, the Company has spent Rs. 1,93,66,947/- (Rupees One Crore Ninety

Three Lakhs Sixty Six Thousand Nine Hundred and Forty Seven Only) towards CSR activity undertaken.

For detailed report refer Annexure –D.

POLICY OF THE NOMINATION AND REMUNERATION COMMITTEE:-

The Company has a Nomination and Remuneration Policy formulated in compliance with Section

178 of the Act read along with the applicable rules thereto as amended from time to time. The

policy shall apply to all Directors (Executive and Non-Executive), Key Managerial Personnel and

Senior Management. The Policy laid down the roles of the Committee, criteria for appointment of

Directors, Key Managerial Personnel and Senior Management and parameters for determining

the remuneration of Directors, Key Managerial Personnel, Senior Management and other

employees, etc. The policy is available on the website of the Company at:

https://simplehai.axisdirect.in/images/RegulatoryDisclosure/Policies/NominationRemuneration

Policy.pdf

DISCLOSURE UNDER THE SEXUAL HARASSMENT OF WOMEN AT WORKPLACE (PREVENTION, PROHIBITION

& REDRESSAL) ACT, 2013:-

The Company has in place a policy for Prevention, Prohibition & Redressal of Sexual Harassment at

workplace which is in line with the requirements of the Sexual Harassment of Women at Workplace

(Prevention, Prohibition & Redressal) Act, 2013 and Rules made thereunder.

All employees are covered under this policy. The Company has constituted an Internal Complaint

Committee for its Head office and branches under Section 4 of the captioned Act.

The details of the number of complaints filed and resolved during the year are as under:-

a. Number of complaints received during the year : 6

(2019-20)

b. Number of complaints disposed off during the year : 5

c. Number of cases pending for more than 90 days : NIL

d. Number of workshops or awareness programs : Organized workshops &

carried out against sexual harassment awareness programs at regular

intervals.

*Investigation of 1 case is under process.

13

A Subsidiary of AXIS BANK

DIRECTORS RESPONSIBILITY STATEMENT:-

Pursuant to sub-section (5) of Section 134 of the Act, the Board of Directors of the Company hereby

state and confirm that:

i. The applicable accounting standards have been followed in the preparation of the annual

accounts and proper explanations have been furnished, relating to material departures.

ii. Accounting policies have been selected, and applied consistently and reasonably, and

prudent judgments and estimates have been made so as to give a true and fair view of the

state of affairs of the Companyat the end of the Financial Year and of the profit of the Company

for the year ended March 31, 2020.

iii. Proper and sufficient care has been taken for the maintenance of adequate accounting

records, in accordance with the provisions of the Actfor safeguarding the assets of the

Company and for preventing and detecting fraud and other irregularities.

iv. The annual accounts of the Company have been prepared on a going concern basis.

v. The directors had laid down internal financial controls to be followed by the Company and

that such internal financial controls are adequate and were operating effectively.

vi. Proper system has been devised to ensure compliance with the provisions of all applicable

laws and such systems are adequate and operating effectively.

COMPLIANCES:-

The Company’s policy on compliance with external regulatory requirements is backed by stringent

internal policies and principles to ensure, Inter alia, priority to clients’ interests over proprietary

interest, maintenance of confidentiality of client information and prevention of insider trading.

AUDITORS:-

i. Statutory Auditors:

Pursuant to the provisions of Section 134 of the Companies Act, 2013 and the Companies (Audit

and Auditors) Rules, 2014, the Company has re-appointed

M/s. S. R. Batliboi & Co. LLP, Chartered Accountants, Mumbai as the Statutory Auditors of the

Company to hold office from the conclusion of 12

th

Annual General Meeting until the conclusion of

the 17

th

Annual General Meeting of the Company.

The Company has received the certificate of eligibility criteria under Section 141 from the Statutory

Auditors.

14

A Subsidiary of AXIS BANK

Also, pursuant to the notification issued by MCA dated May 7, 2018, the requirement of ratifying

the appointment of Statutory Auditors in every Annual General Meeting is done away.

ii. Secretarial Auditors:

Pursuant to the provisions of Section 204 of the Companies Act, 2013 and The Companies

(Appointment and Remuneration of Managerial Personnel) Rules, 2014, the Company has re-

appointed M/s. BNP & Associates, Practicing Company Secretaries, to undertake the Secretarial

Audit of the Company for the financial year under review. The Report of the Secretarial Audit

Report is annexed herewith as Annexure - E.

iii. Internal Auditors:-

Pursuant to the provisions of Section 138 of the Companies Act, 2013 and the Companies (Accounts)

Rules, 2014, the Company has appointed

M/s. RVA &Associates, LLP Chartered Accountantsto undertake the Internal Audit of the Company

for the financial year under review.

CORPORATE GOVERNANCE:-

The Company’s policy on Corporate Governance is as under:

i. To enhance the long term interest of its shareholders, provide good management, adopt

prudent risk management techniques and comply with the applicable regulatory requirements,

thereby safeguarding the interest of its other stakeholders such as customers, employees,

creditors and vendors.

ii. To identify and recognize the Board of Directors and the Management of the Company as

the principal instruments through which good corporate governance principles are articulated

and implemented.

iii. To also identify and recognize accountability, transparency and equality of treatment for all

stakeholders, as central tenets of good corporate governance.

FUTURE OUTLOOK:-

Retail Broking:

Equity markets are passing through one of the worst crisis since 2008; the corona pandemic has

brought the world to standstill, with disrupted economic activities and lockdown of various extents

following the standard operating procedures to contain the spread. IMF expects the global

economy to contract by 3%, the US economy to shrink by around 6%, Europe by 7.5%; Indian and

China to grow at a measly rate of 1.9% and 1.2% respectively. According to the IMF, India is expected

to recover sharply in the next fiscal year posting 7.4% GDP growth.

15

A Subsidiary of AXIS BANK

Back home, the economy is completely at standstill for the month of April due to extension of

lockdown till May 3, 2020 though partial relaxations have been offered for essential goods industries

and relatively unaffected geographies. Post resumption of normalcy, the business would start

functioning keeping the social distancing norms. On account of the disruption in economic activities,

the earnings cycle is expected to be impacted at least for Q1FY21 but repercussions of the fall in

economic activities is expected to be seen in the financial sector as delinquencies are expected

to be spread in the rest of the year.

The government has already come up with relief measures to protect the lower strata of the society

and few more steps/stimulus is expected shortly to ensure continuity in businesses and protect

jobs. Global lockdown led demand destruction has caused a sharp drop in crude oil prices which

was already suffering from surplus supply; savings from crude oil imports would give legroom to

Indian government for infrastructure investment. RBI has taken proactive measures viz., reduced

the policy rates, cut CRR unlocking liquidity to mitigate the impact of COVID-19 crisis; temporary

moratorium of three months on payments of installments of all term loans (home, auto, personal,

agricultural, retail and crop loans) outstanding as of March 1, 2020 has also been granted. Moreover,

the central bank has assured to step in as and when required to ensure economic stability and

sufficient liquidity in the financial system.

Indian economy is expected to face real challenges as it exits lockdown; it would have to confront

potential labour shortages as the migrant labour would have left for their home towns/villages.

Getting them back at reasonable cost would be a tough challenge in the immediate future to

ensure wheels of industrial economy are put in motion. In addition, the administration would have

to ensure social distancing to ensure a second wave of infections, if any, does not occur. Moreover,

investments in specialized medical facilities at possibly every district level would be a need of hour

to attend any outbreak in future. Additional challenges like stressed corporate balance sheet esp.

NBFCs, resource strapped state and weakened MSMEs would have to be dealt with adroitly. Overall,

FY21 is expected to be a challenging year.

Indian Meteorological Dept. has indicated a ‘normal’ monsoon for 2020; good Rabi harvest and

neutral ENSO cycle (indicating normal monsoon) is likely to support demand from both rural and

urban economy for staples and discretionary consumption while low interest rates would augur

well for autos, housing/ real estate & housing finance, banking and other interest rate sensitive

sectors though capital investments are likely to be deferred given the uncertainty with demand

growth. Commodity prices are expected to trade low given the demand supply mismatch thus

benefiting the user industries.

Equity markets are expected to be volatile given the precarious situation of developed economies;

markets are expected to be driven by global market movements and the FII buying/ selling numbers

in the short term. Inadequate measures taken by developed economies (like premature opening

of lockdown without precautionary steps) to contain the virus and the possibility of a second wave

of increase in infection is also expected to keep the markets on its toes. Selling in large caps from

the overseas ETF investors or sovereign funds from Oil rich nations would also keep the indices low

in near term. Fundamentally, the recovery would happen somewhere post Q1FY21 as the market

16

A Subsidiary of AXIS BANK

participants factor in and look beyond the downgrades of FY21 earnings of India Inc. and start

building in earnings recovery for FY22.

AWARDS & RECOGNITION:-

During the year, the Company received accolades for its initiatives. During the year, the Company

has been awarded the following:

i. Commodity and Equity Outlook 2019(CEO 2019) in June 2019 for Retail Broker of the year.

SECRETARIAL STANDARDS:-

During the year under review, the Company has complied with the applicable Secretarial Standard

issued by Institute of Company Secretaries of India.

ACKNOWLEDGEMENT:-

Your Directors would like to express their gratitude for all the guidance and co-operation received

from its holding company - Axis Bank Limited. Your Directors would like to place on record their

gratitude to the esteemed Clients, Bankers, Financial Institutions, Suppliers, Service providers, Advisors,

Securities and Exchange Board of India (SEBI), National Stock Exchange of India Limited (NSE), BSE

Limited(BSE), National Securities Depository Limited (NSDL), Central Depository Services (India) Limited

(CDSL), Ministry of Corporate Affairs, Multi Commodity Exchange of India Limited (MCX), National

Commodity & Derivatives Exchange Limited (NCDEX), Metropolitan Stock Exchange of India Limited

(MSEI),Insurance Regulatory and Development Authority(IRDA), Central, State and Local

Government Departments for their continued support and cooperation.

The Directors also express their warm appreciation to all the employees of the Company for their

diligence and contribution.

For and on Behalf of the Board of Directors

Pralay Mondal

Chairman

DIN: 00117994

Address: Flat No. 1901 & 1902, Wing E,

Rustomjee Paramount, 18th Road,

Vithaldas Nagar, Khar West, Mumbai 400052

Place : Mumbai

Date : April 23, 2020

17

A Subsidiary of AXIS BANK

Form No. MGT-9 Annexure A

EXTRACT OF ANNUAL RETURN

as on the financial year ended on March 31, 2020

[Pursuant to Section 92(3) of the Companies Act, 2013 and Rule 12(1)of the

Companies (Management and Administration) Rules, 2014]

I. REGISTRATION AND OTHER DETAILS

i. CIN : U74992MH2006PLC163204

ii. Registration Date : 21/07/2006

iii. Name of the Company : Axis Securities Limited

iv. Category / Sub-Category of : Public Unlisted Company

the Company

v. Address of the Registered office : Axis House, 8

th

Floor, Wadia International Centre,

and contact details Pandurang Budhkar Marg, Worli, Mumbai – 400 025,

Maharashtra, India

Telephone No - 022 24252009

Email id – [email protected]

vi. Whether listed company : No

vii. Name, Address and Contact : M/s. Karvy Computershare Private Limited

details of Registrar and Transfer Karvy Selenium Tower- B, Plot No 31 & 32,

Agent, if any Gachibowli, Financial District, Nanakramguda,

Serilingampally, Hyderabad - 500 008, India.

Telephone No. : +91 040 67161604

II. PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY

All the business activities contributing 10% or more of the total turnover of the Company shall

be stated:-

Sr. Name and Description of main NIC Code of the % to total turnover

No. products/services Product/service of the Company

1. Business Sourcing and Resource

Management 99831130 12.72%

2. Brokerage on Securities 99715210 87.28%

III. PARTICULARS OF HOLDING, SUBSIDIARY AND ASSOCIATE COMPANIES:

Sr. Name and address of the CIN/GLN Holding/ % of Applicable

No. Company Subsidiary/ shares Section

Associate held

1. Axis Bank Limited

Trishul, 3

rd

Floor, L65110GJ1993PLC020769 Holding 99.999958 % 2(46)

Opp. Samartheshwar Temple,

Law Garden Ellisbridge,

Ahmedabad – 380006

18

A Subsidiary of AXIS BANK

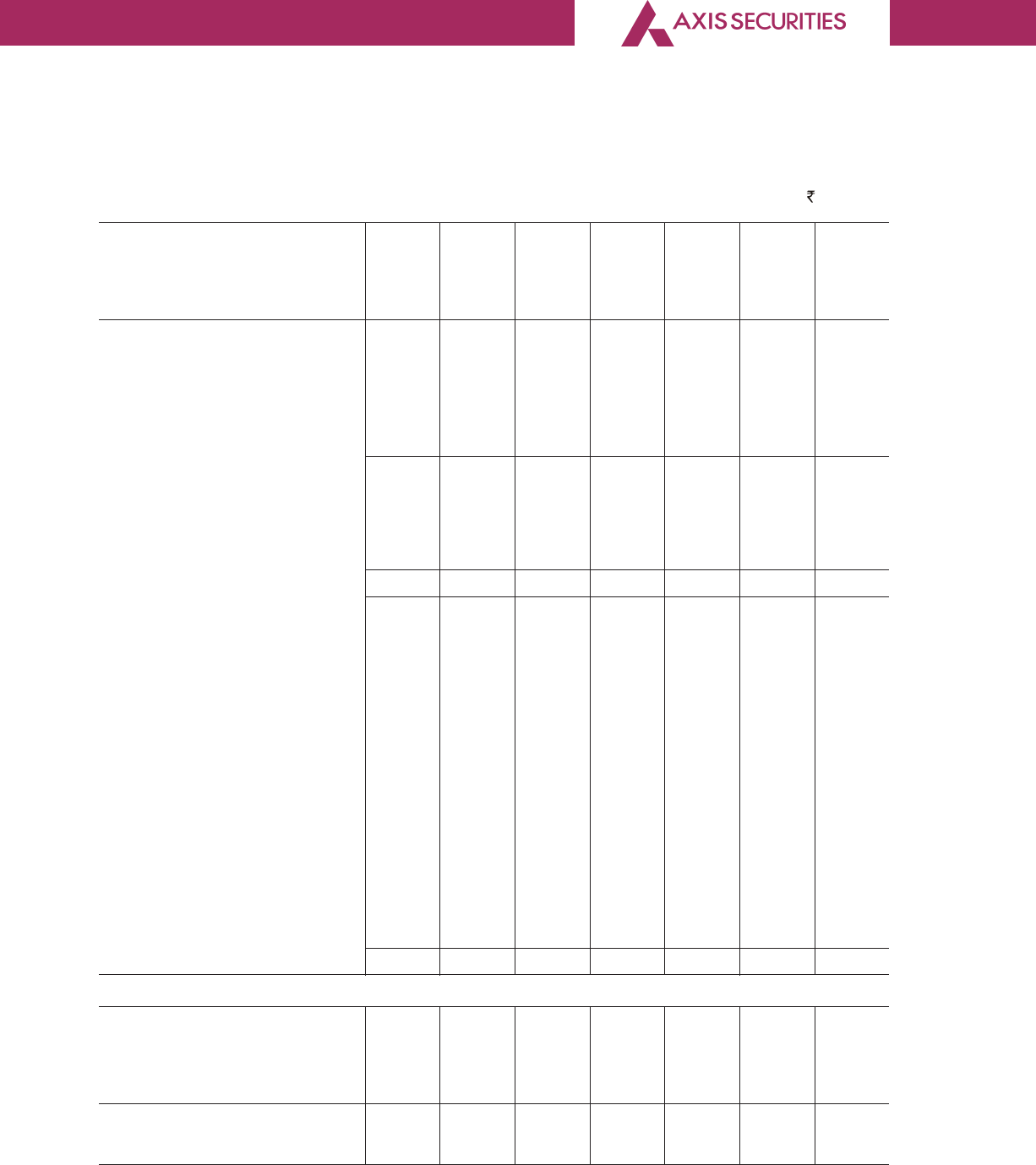

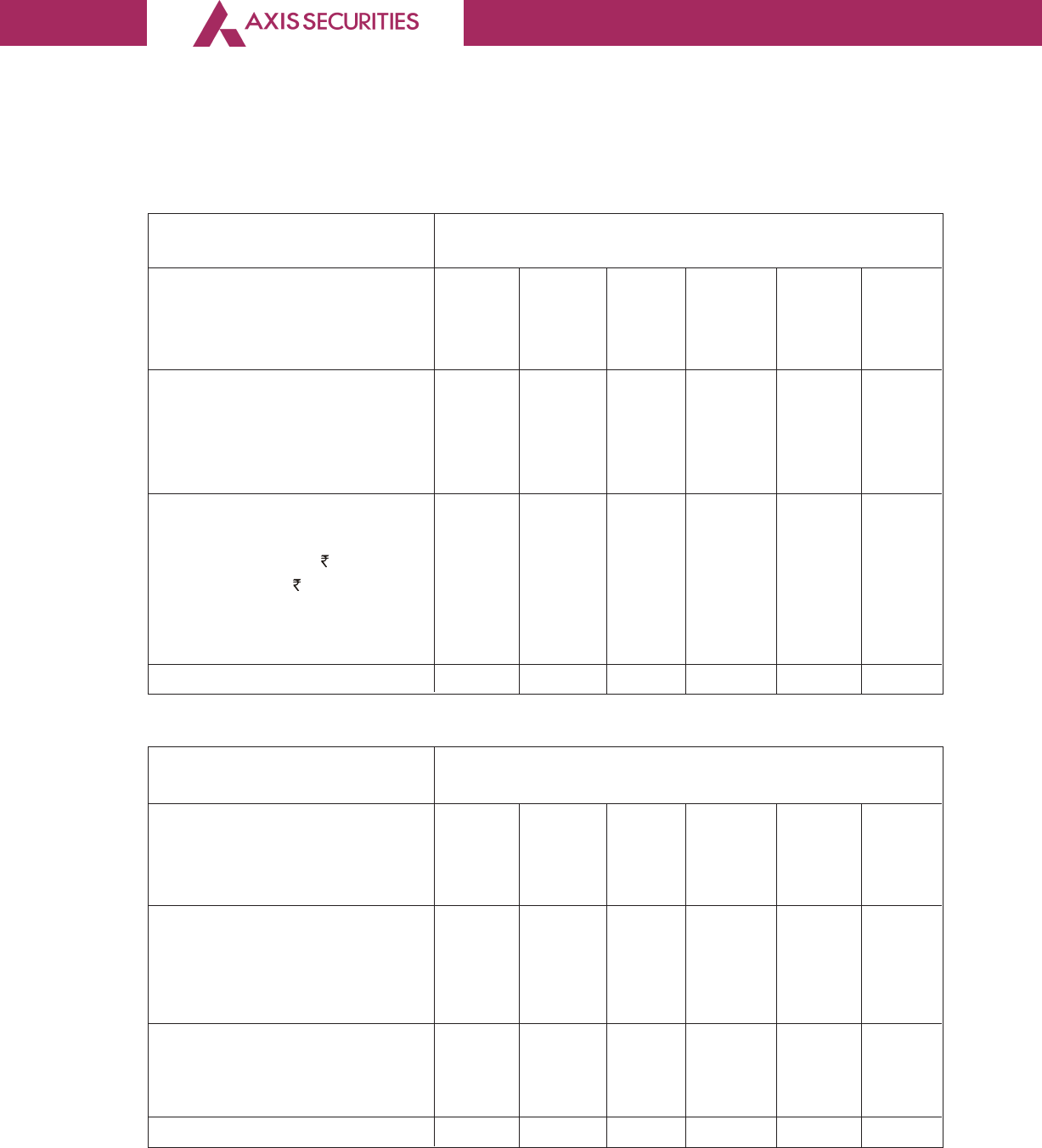

IV. SHAREHOLDING PATTERN (Equity Share Capital Breakup as percentage of Total Equity)

i. Category - wise Share Holding

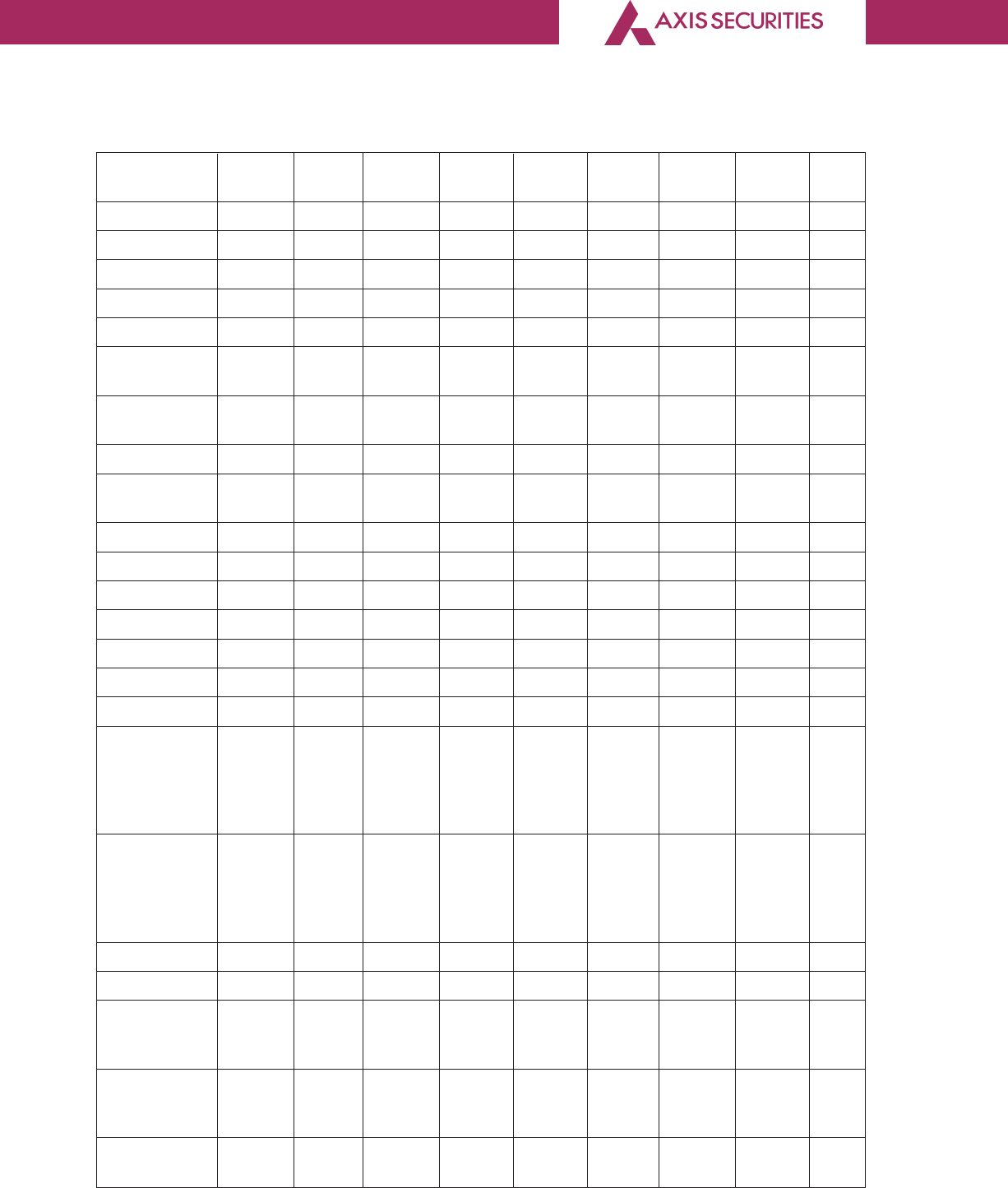

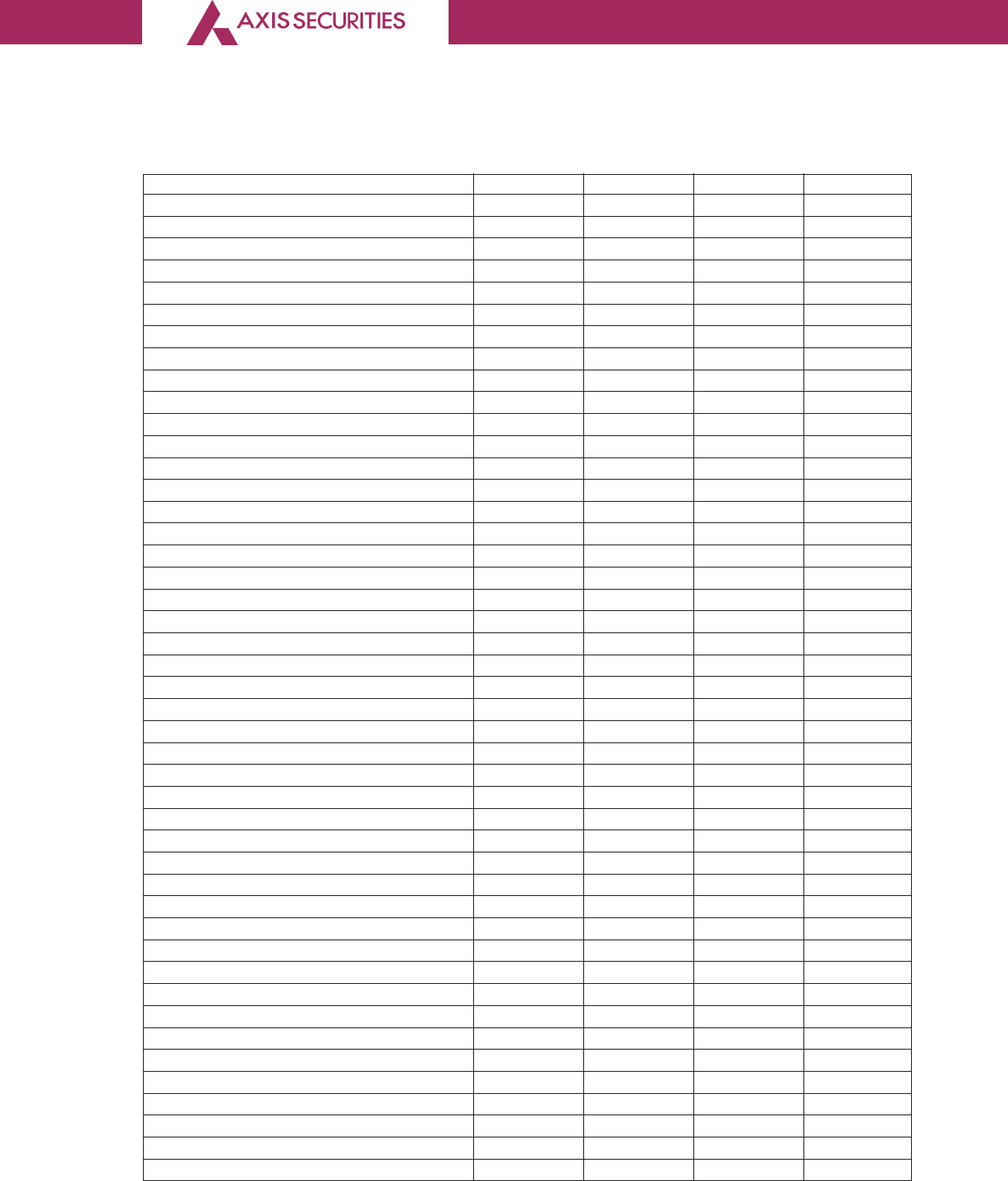

Category No. of shares held at the No. of shares held at the %change

of beginning of the year end of the year during

shareholders the year

Demat Physical Total % of Demat Physical Total % of

Total Total

shares shares

A. Promoters

(1) Indian

a) Individual / – – – – – – – – –

HUF

b) Central Govt. – – – – – – – – –

c) State Govt(s) – – – – – – – – –

d) Bodies Corp. – – – – – – – – –

e) Banks / FI 144,499,940 – 144,499,940 99.999958%144,499,940 – 144,499,940 99.999958% NIL

f) Any Other… – – – – – – – – –

Sub-total (A) (1): 144,499,940 – 144,499,940 99.999958%144,499,940 – 144,499,940 99.999958% NIL

(2) Foreign

a) NRIs - – – – – – – – – –

Individuals

b) Other – – – – – – – – – –

Individuals

c) Bodies Corp. – – – – – – – – –

d) Banks / FI – – – – – – – – –

e) Any Other…. – – – – – – – – –

Sub-total ––– –––– ––

(A) (2)

Total share-

holding of 144,499,940 – 144,499,940 99.999958%144,499,940 – 144,499,940 99.999958% NIL

Promoter (A) =

(A)(1)+(A)(2)

19

A Subsidiary of AXIS BANK

B. Public Share-

holding

1. Institutions

a) Mutual Funds – – – – – – – – –

b) Banks/ FI – – – – – – – – –

c) Central Govt – – – – – – – – –

d) State Govt(s) – – – – – – – – –

e) Venture Capital

Funds – – – – – – – – –

f) Insurance

Companies – – – – – – – – –

g) FIIs – – – – – – – – –

h) ForeignVenture

Capital Funds – – – – – – – – –

i) Others (specify) – – – – – – – – –

Sub-total (B)(1):- –– – ––– – ––

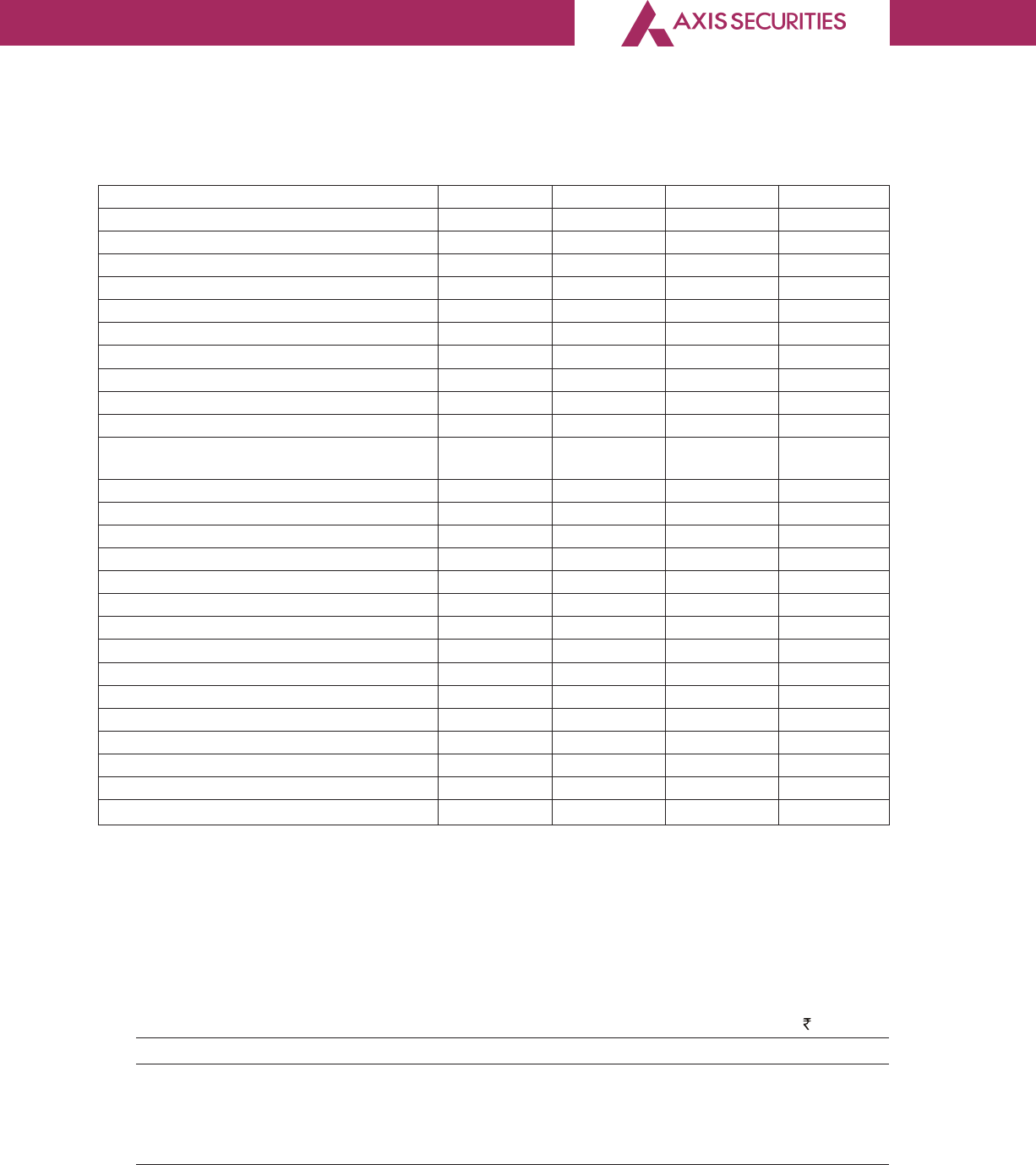

2. Non-Institutions

a) Bodies Corp. – – – – – – – – –

i) Indian – – – – – – – – –

ii) Overseas – – – – – – – – –

b) Individuals

i) Individual 60 – 60 0.000042% 60 – 60 0.000042% NIL

shareholders

holding nominal

share capital

upto Rs.1 lakh

ii) Individual share- – – – – – – – – –

holders holding

nominal share

capital in excess

of Rs. 1 lakh

c) Others(specify) – – – – – – – – –

Sub-total(B)(2):- 60 – 60 0.000042% 60 – 60 0.000042% NIL

Total Public 60 – 60 0.000042% 60 – 60 0.000042% NIL

Shareholding (B)=

(B)(1)+ (B)(2)

C. Shares held by – – – _ _ _ _ _ _

Custodian for

GDRs &ADRs

Grand Total

(A+B+C) 144,500,000 – 144,500,000 100% 144,500,000 – 144,500,000 100% _

20

A Subsidiary of AXIS BANK

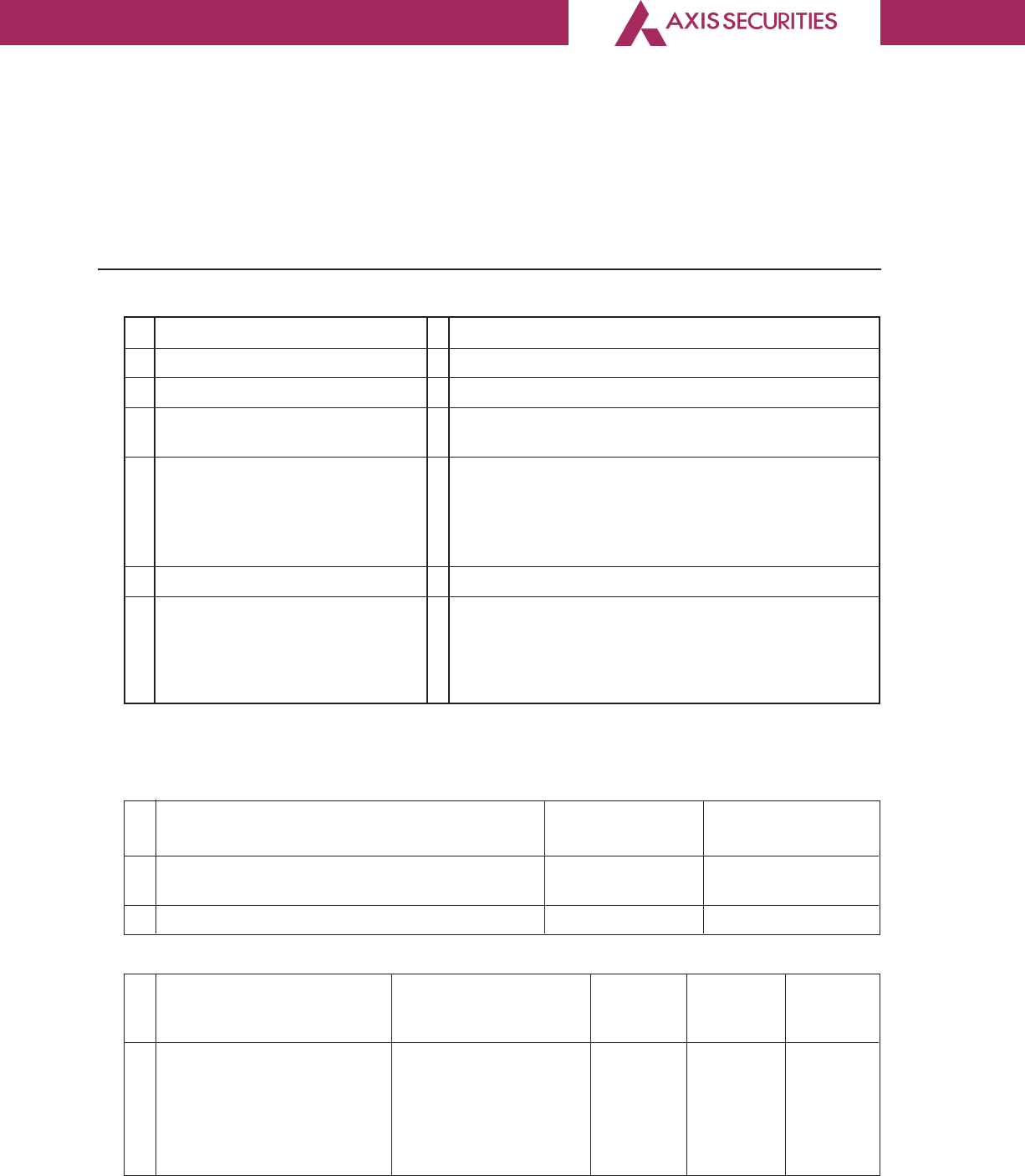

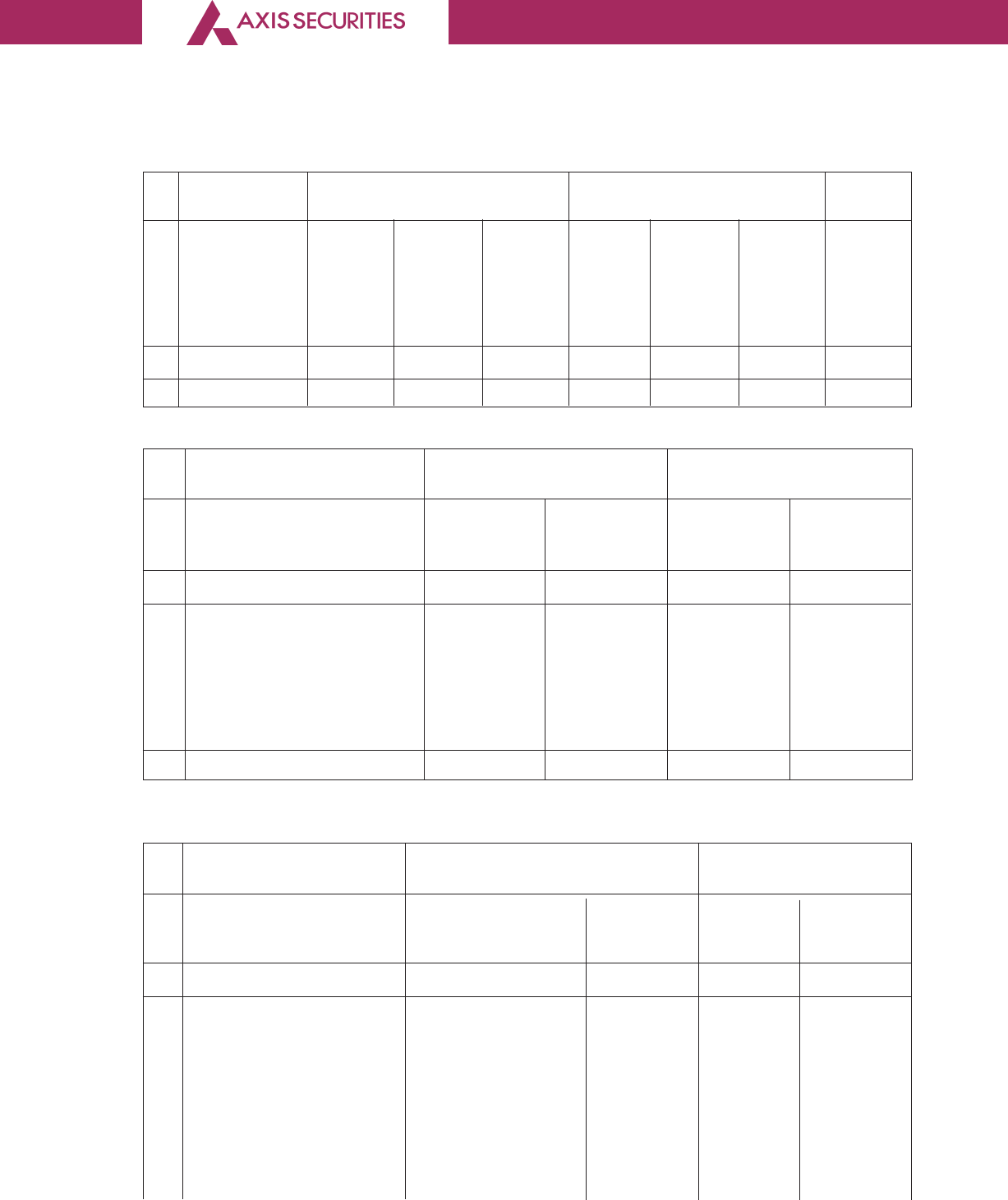

ii. Share Holding of Promoters

Sr. Shareholder’s Shareholding at the Shareholding at the

No. Name beginning of the year end of the year

No. of % of % of Shares No. of % of % of % Change

Shares total Pledged/ Shares total Shares in share

Shares encum- shares Pledged/ holding

of the bered to of the encum- during

Company total Company bered to the year

Shares total Shares

1. Axis Bank Limited 144,499,940 99.999958 % – 144,499,940 99.999958 % – –

Total 144,499,940 99.999958 % – 144,499,940 99.999958 % ––

iii. Change in Promoters’ Shareholding (please specify, if there is no change): NO CHANGE

Sr. Shareholding at the Cumulative Shareholding

No. beginning of the year during the year

No. of shares % of total No. of shares % of total

shares of the shares of the

company company

1. At the beginning of the year – – – –

2. Datewise Increase / – – – –

Decrease in Promoters Share

holding during the year

specifying the reasons for

increase/ decrease

(e.g. allotment / transfer /

bonus/ sweat equity etc):

3. At the End of the year – – – –

iv. Shareholding Pattern of top ten Shareholders (other than Directors, Promoters and Holders of

GDRs and ADRs):

Sr. Shareholding at the Cumulative Shareholding

No. beginning of the year during the year

For Each of No. of shares % of total No. of % of total

the Top 10 shares of the shares shares of the

Shareholders company company

1. At the beginning of year 40 0.000028% 40 0.000028%

2. Date wise Increase 09/05/2019

/ Decrease in Share Mr. Rajiv Anand

holding during the year Directors holding 10

specifying the reasons Shares resigned as

for increase /decrease the Directors of the 0.000007% 10 0.000007%

(e.g. allotment / transfer / Company

bonus / sweat equity etc): 22/05/2019

*10 Equity Shares held

by Mr. Arun Thukral

were trans fered to

Mr. Himadri Chaterjee

21

A Subsidiary of AXIS BANK

05/12/2019

*10 Equity Shares

held by Mr. Cyril 0 0 0

Anand were

transferred to

Mr. Pralay Mondal

(Director)

02/03/2020 0.000007% 10 0.000007%

*10 Equity Shares

held by Mr. Jairam

Sridharan were

transferred to

Mr. Ravi Narayan

3. At the End of the year 50 0.000035% 40 0.000035%

(or on the date of

separation, if separated

during the year)

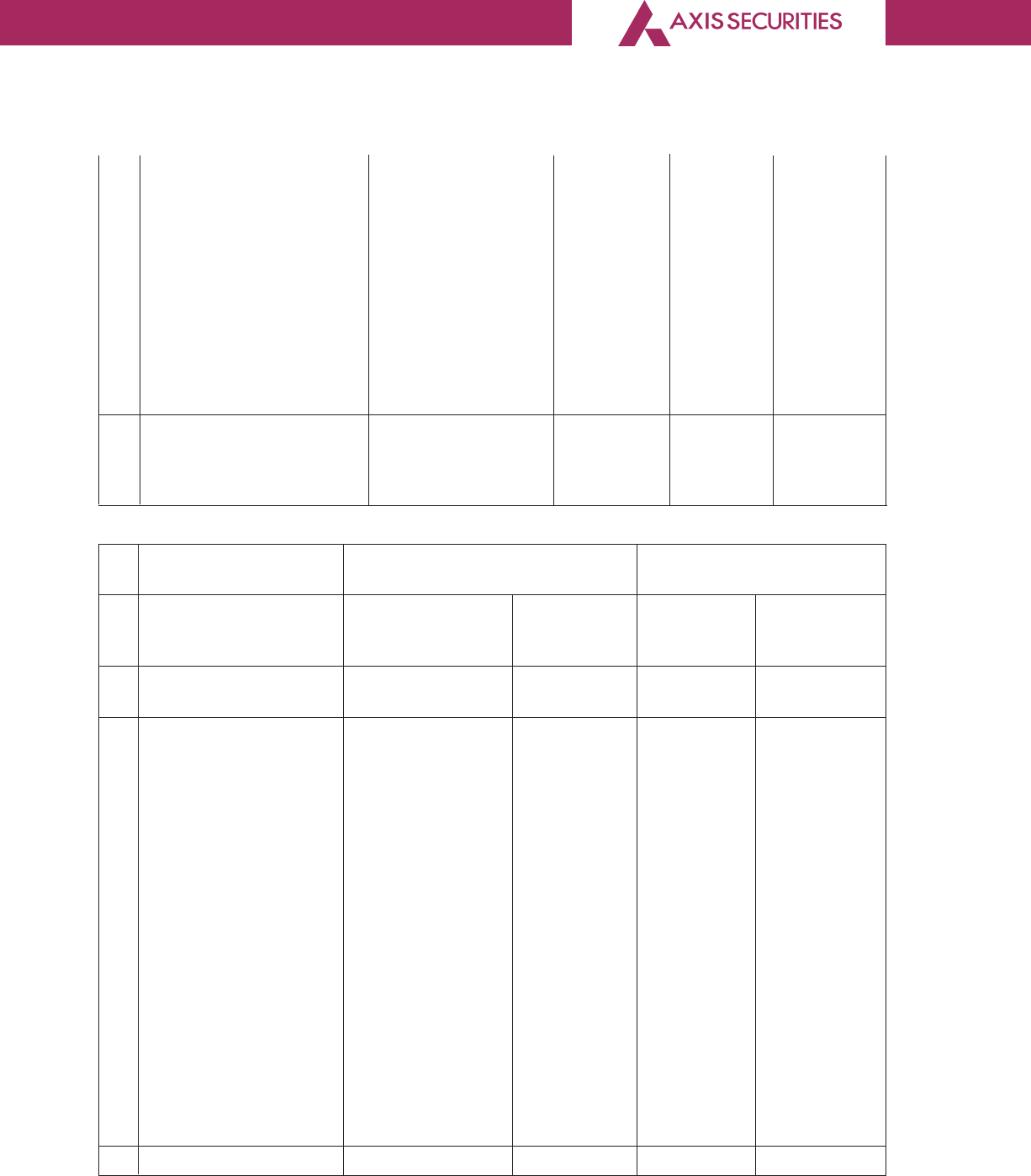

v. Shareholding of Directors and Key Managerial Personnel:

Sr. Shareholding at the beginning Cumulative Shareholding

No. of the year during the year

For Each of the No. of % of total No. of % of total

Directors and shares shares of the shares shares of the

KMP company company

1. At the beginning 20 0.000014% 20 0.000014%

of the year

2. Date wise Increase / 09/05/2020 0.000007% 10 0.000007%

Decrease in Share- Mr. Rajiv Anand

holding during the Director holding

year specifying the 10 shares

reasons for increase/ resigned as the

decrease (e.g. Director of

allotment / transfer / the Company

bonus/ sweat equity 22/05/2019

etc): *10 Equity Shares

held by Mr. Arun

Thukral were

transferred to Mr.

Himadri Chatterjee

05/12/2019

*10 Equity Shares

held by Mr. Cyril

Anand were

transferred to

Mr. Pralay

Mondal (Director)

3. At the End of the year 10 0.000007% 10 0.000007%

22

A Subsidiary of AXIS BANK

V. INDEBTEDNESS:

Indebtedness of the Company including interest outstanding/accrued but not due for payment:

Secured Loans Unsecured Deposits Total

excluding Loans Indebtedness

deposits

Indebtedness at the beginning ––––

of the financial year

i) Principal Amount

ii) Interest due but not paid

iii) Interest accrued but not due

Total (i+ii+iii) ––––

Change in Indebtedness during

the financial year

• Addition – – – –

• Reduction – – – –

Net Change ––––

Indebtedness at the end of the ––––

financial year

i) Principal Amount

ii) Interest due but not paid

iii) Interest accrued but not due

Total (i+ii+iii) ––––

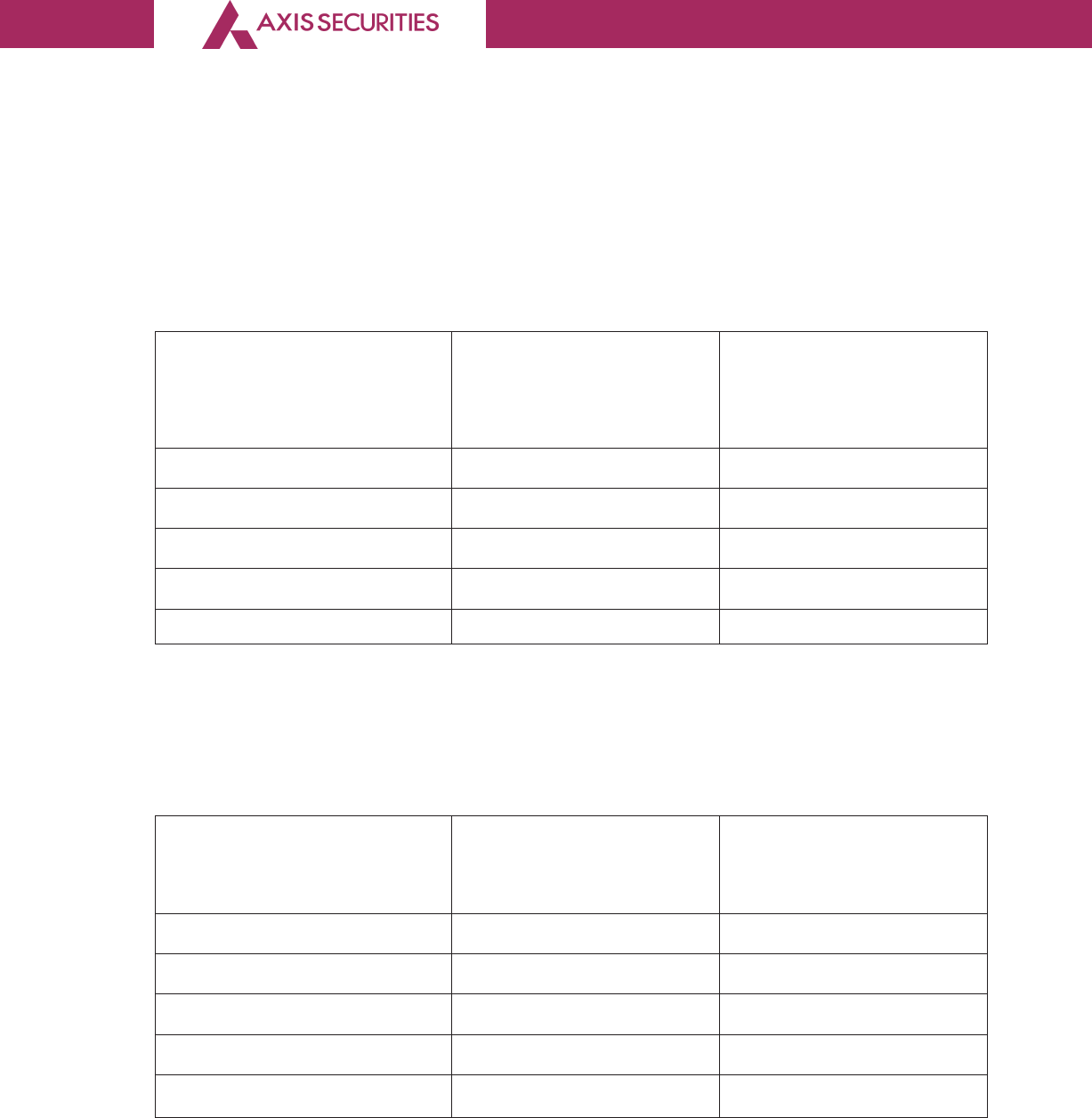

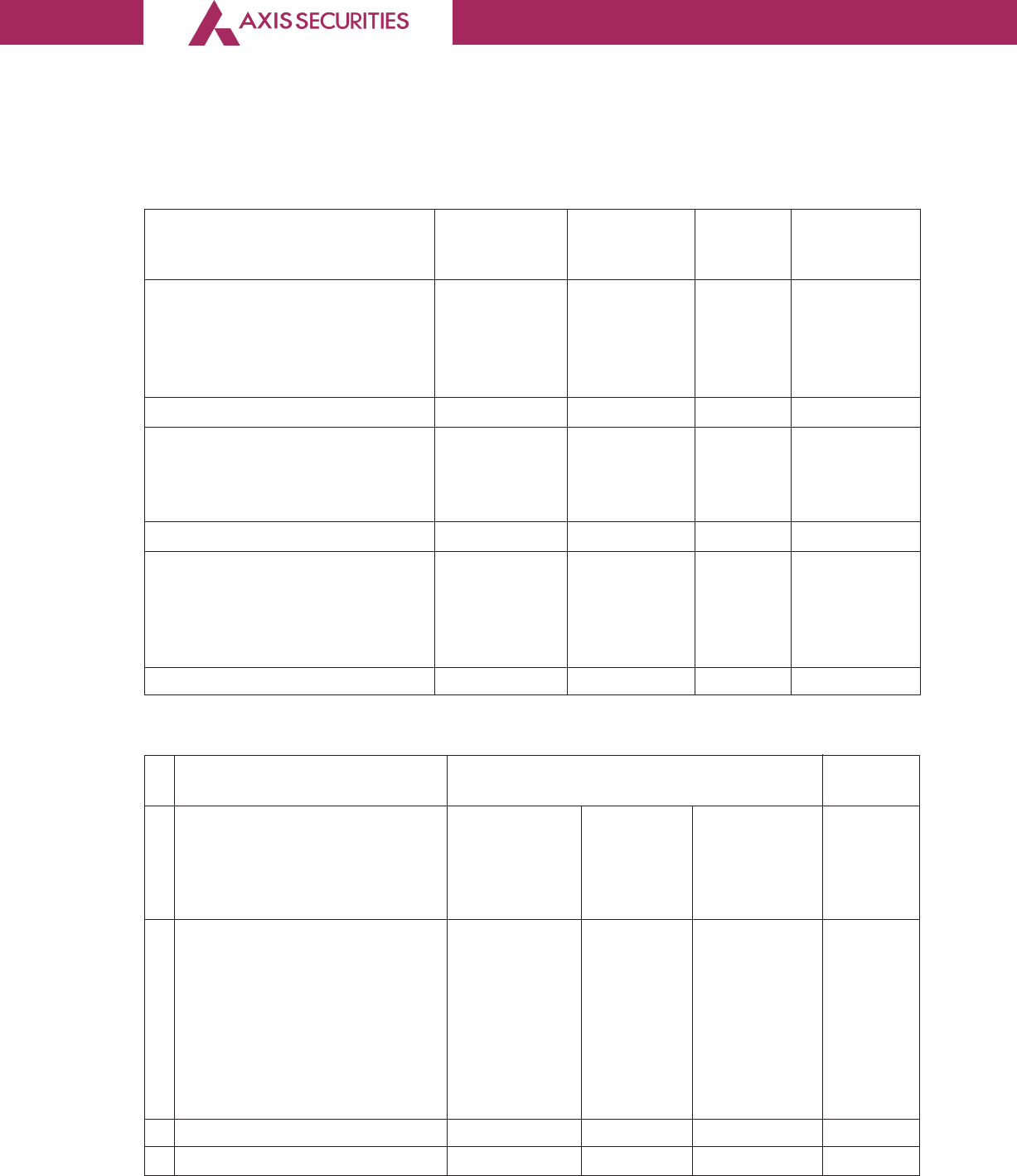

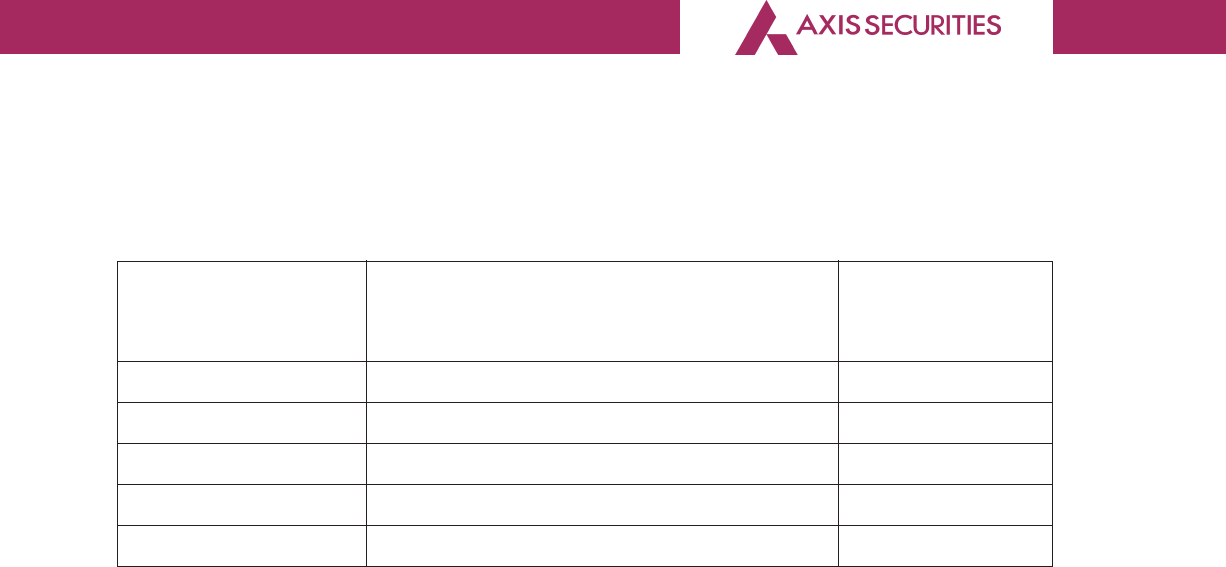

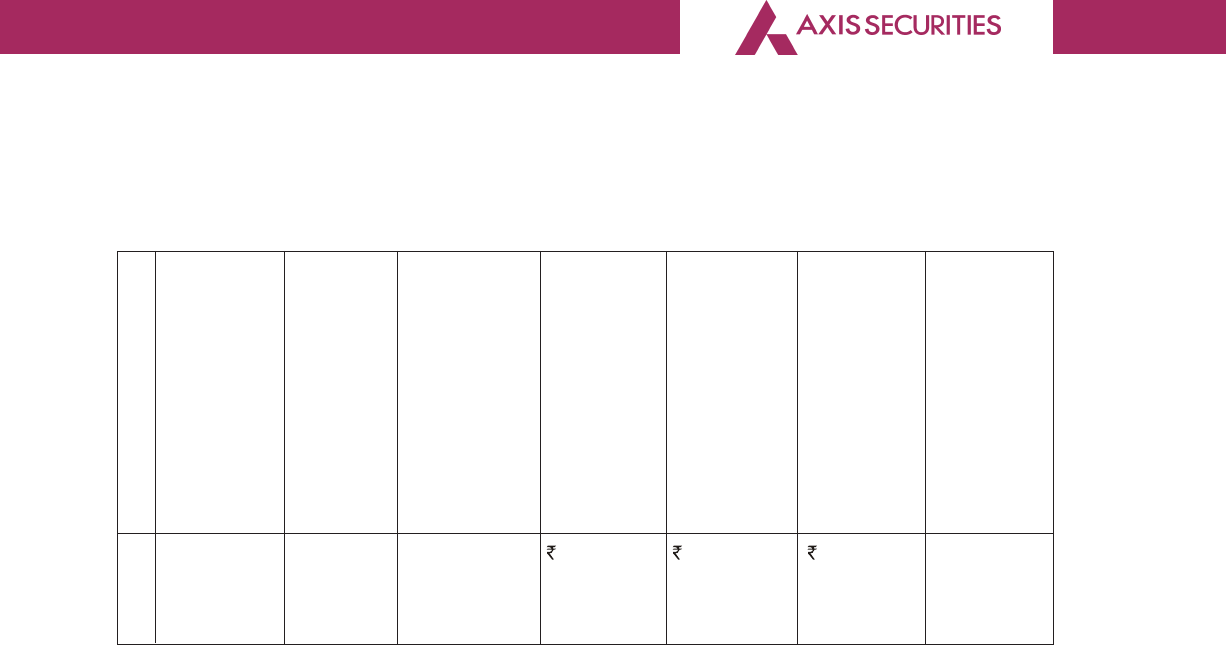

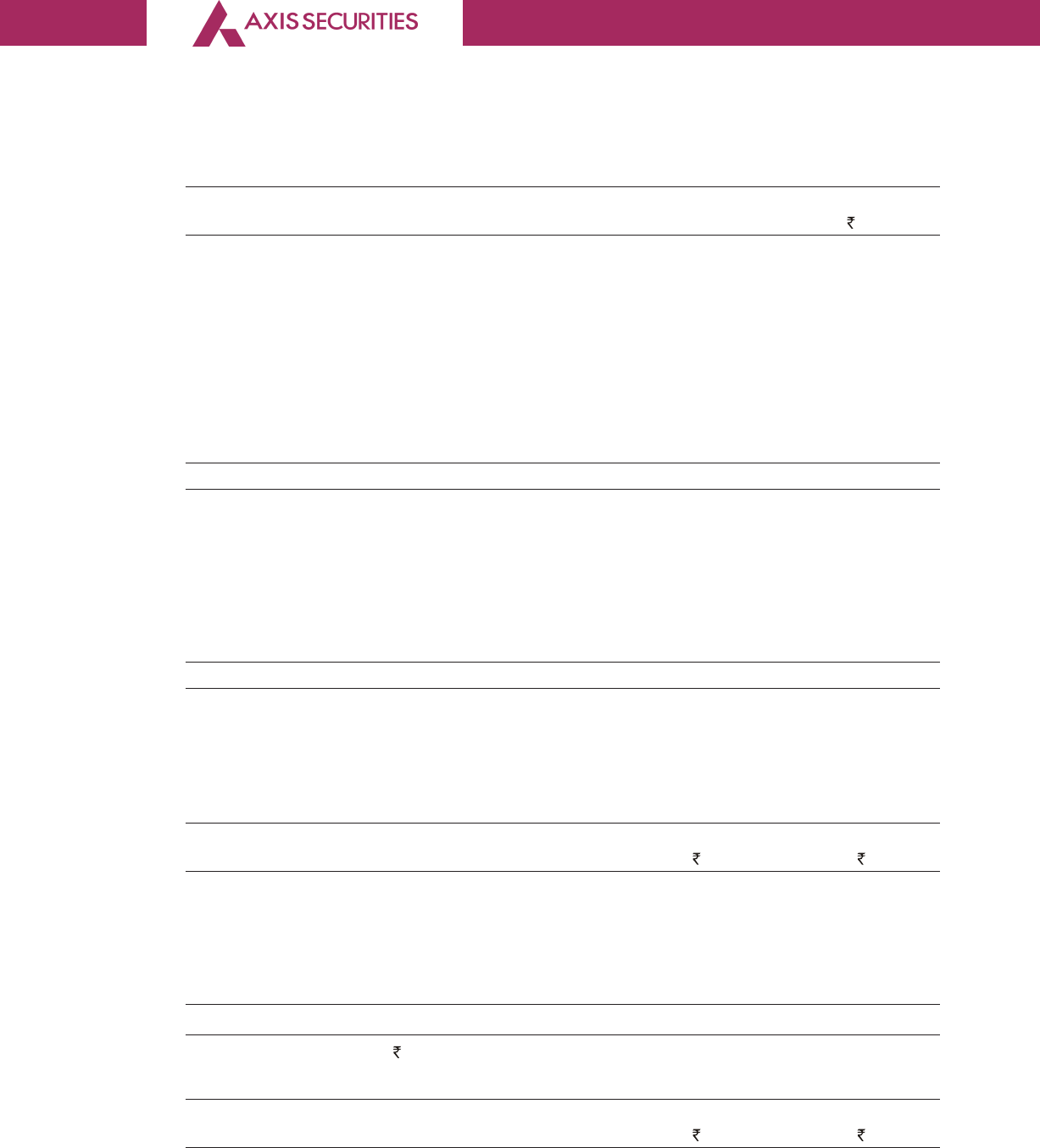

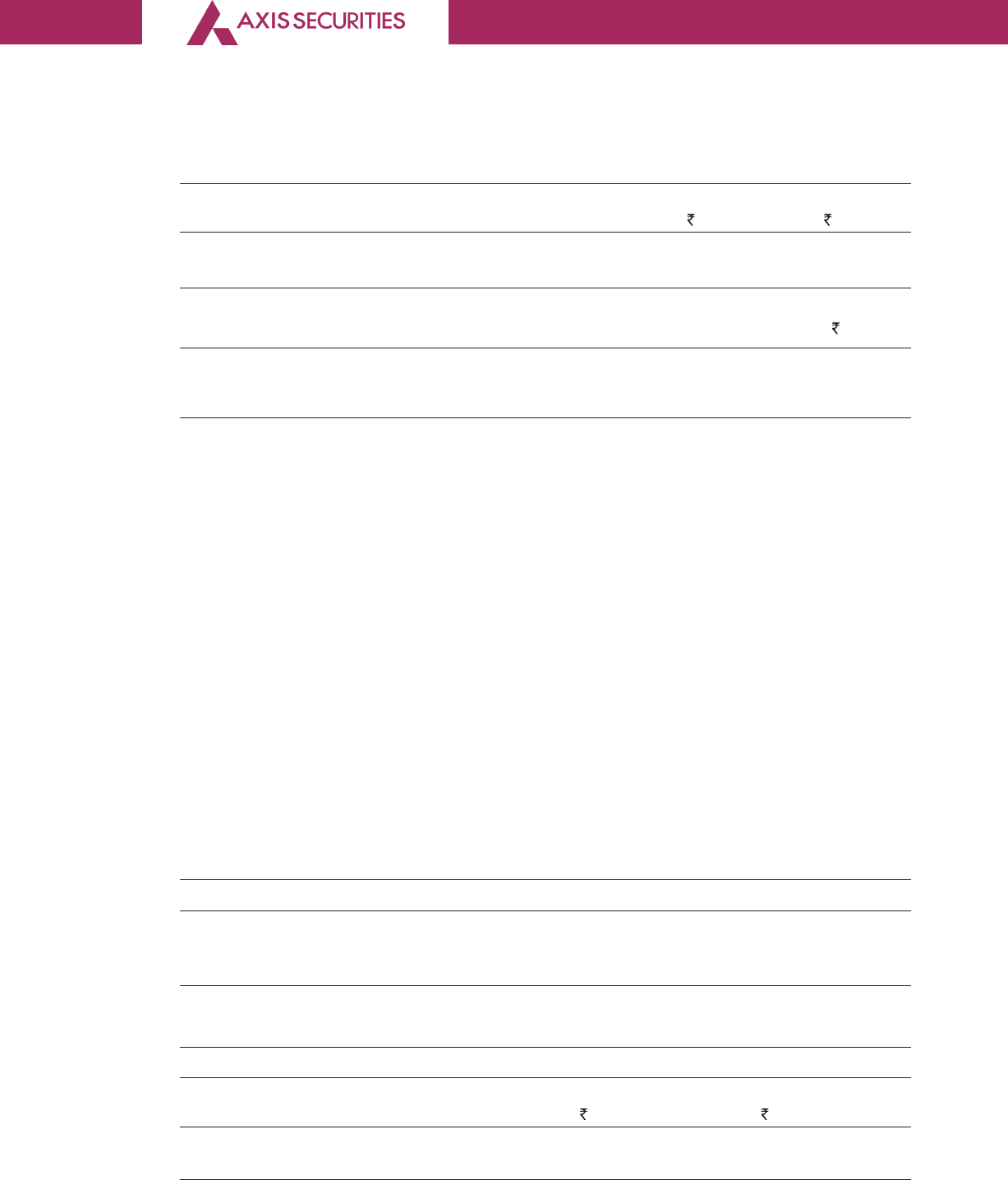

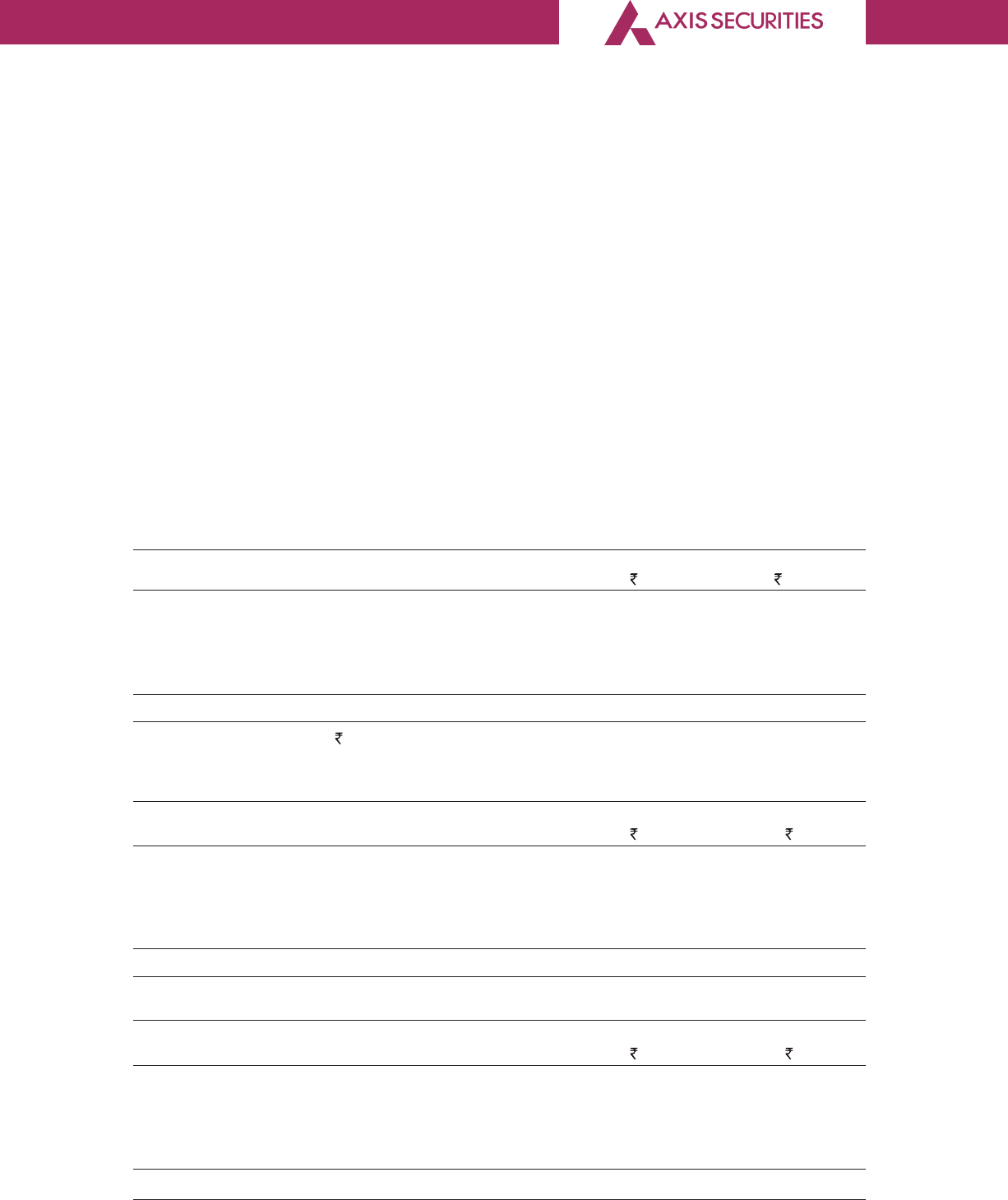

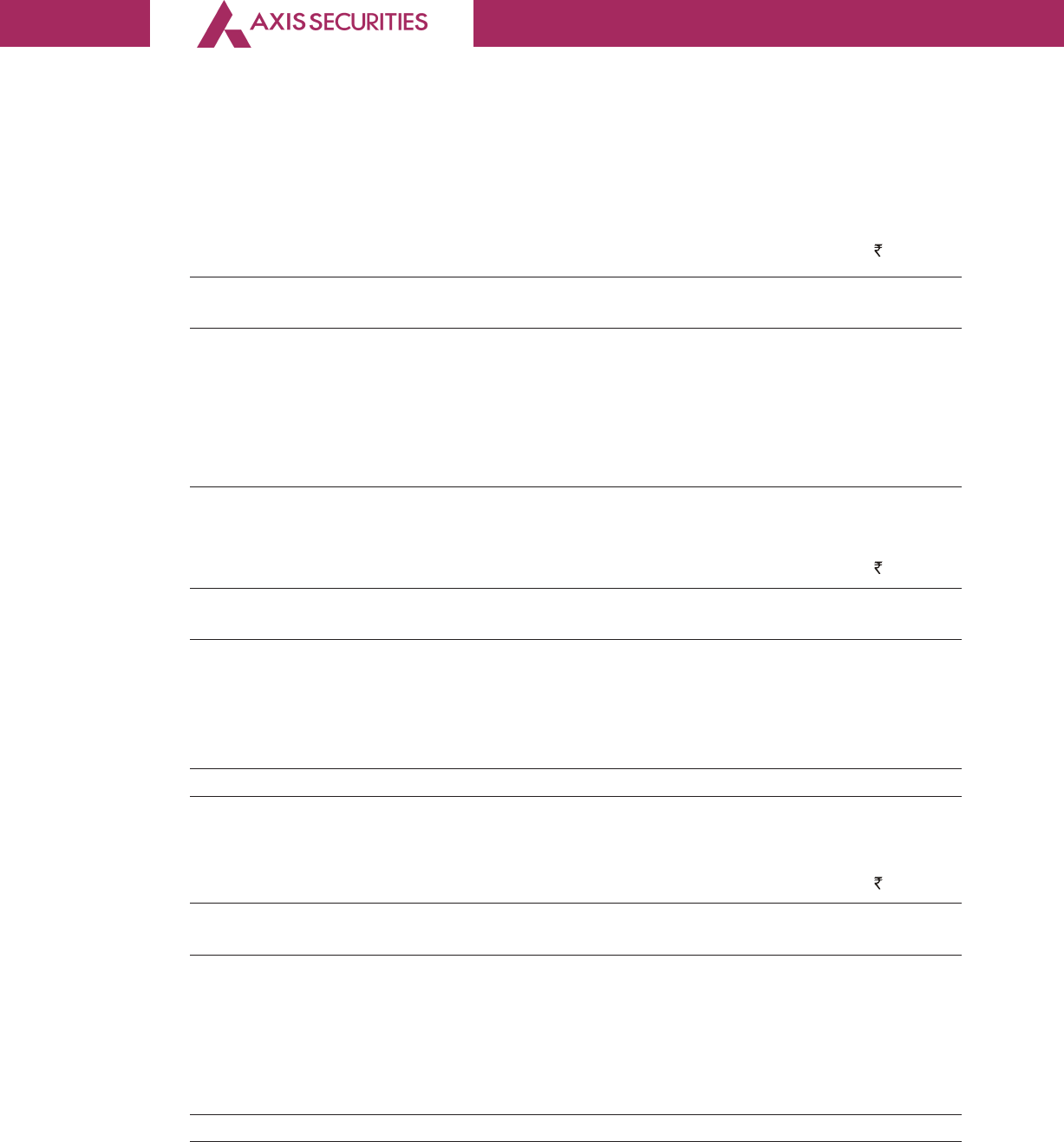

VI. REMUNERATION OF DIRECTORS AND KEY MANAGERIAL PERSONNEL :

A. Remuneration to Managing Director, Whole-time Directors and/or Manager: (Figures is Rs.)

Sr. Particulars Name of MD / WTD / Manager Total

No. of Remuneration Amount

Arun Thukral, Gop Kumar Anand Kumar

Managing Bhaskaran, Shaha,

Director & CEO Managing Whole-Time

(01.04.2019- Director Director

31.12.2019) & CEO

1. Gross salary

(a) Salary as per provisions 14,072,123 10,427,788 9,425,068 3,39,24,979

contained in section 17(1)

of the Income-tax Act, 1961

(b) Value of perquisites u/s

17(2) Income-tax Act, 1961

(c) Profits in lieu of salary under

section 17(3) Income-tax

Act, 1961

2. Stock Option

3. Sweat Equity

23

A Subsidiary of AXIS BANK

4. Commission

- as % of profit – – –

- others, specify.... – – –

5. Others, please specify – – –

Total (A) 14,072,123 10,427,788 9,425,068 3,39,24,979

Ceiling as per the Act

5% of the net Profit

5% of the 10% of the

net Profit net Profit

B. Remuneration to other directors:

Sr. Particulars of Name of Directors Total

No. Remuneration Amount

Rajiv Pralay Babu Rao Nithya Bhumika Ramesh Jagdeep

Anand Mondal Busi Easwaran Batra Kumar

Malla-

Bammi

reddy

1. Independent – – 6,50,000 1,50,000 3,50,000 300,000 – 14,50,000

Directors

• Fee for attending

Board & Committee

meetings

• Commission

• Others, please

specify

Total (1) – – 6,50,000 1,50,000 3,50,000 300,000 – 14,50,000

2. Other Non-Executive

Directors

• Fee for attending

Board & Committee

meetings

• Commission

• Others, please

specify

Total (2) –

Total (B)=(1+2) – – 6,50,000 1,50,000 3,50,000 300,000 – 14,50,000

Total Managerial –

Remuneration

Overall Ceiling as – – – –

–

––

1% of the

per the Act

net profit

24

A Subsidiary of AXIS BANK

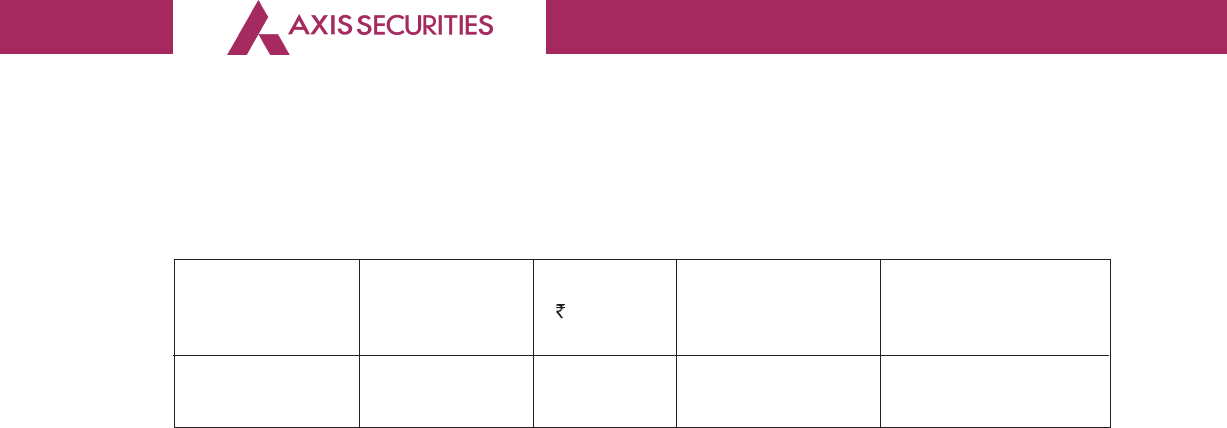

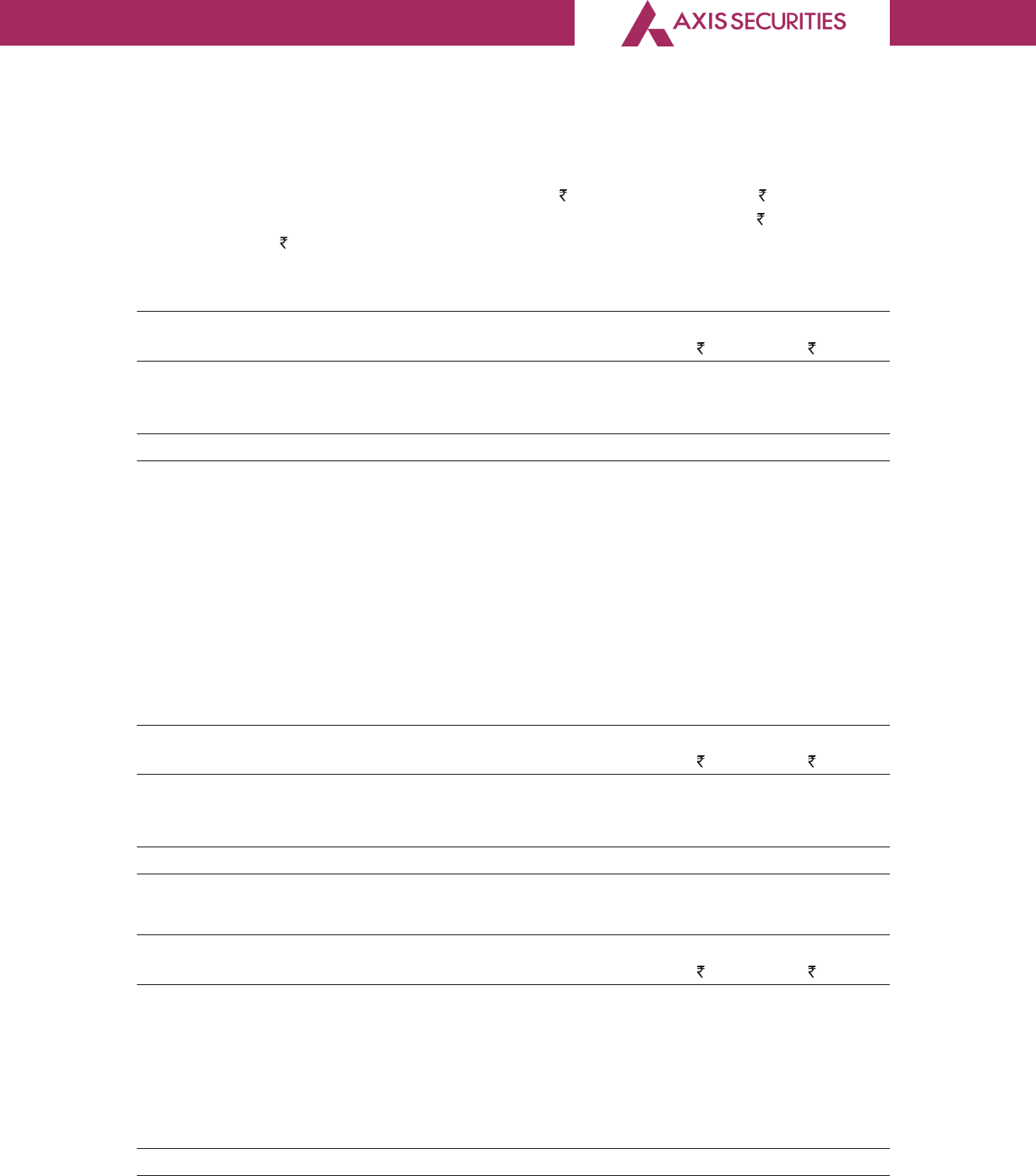

C. Remuneration to Key Managerial Personnel other than MD/Manager/WTD (Figures is Rs.)

Sr. Particulars of Remuneration Key Managerial Personnel

no.

CEO Ms. Lovelina Mr. Divya Mr. Hemant Total

Faroz, Poojari, Patel,

Company Company CFO

Secretary Secretary

01.04.2019 30.01.2020-

31.03.2020

1. Gross salary

(a) Salary as per provisions _ 9,69,514 3,03,992 58,66,047 71,39,553

contained in section 17(1)

of the Income-tax Act, 1961

(b) Value of perquisites u/s 17(2)

Income-tax Act, 1961

(c) Profits in lieu of salary under

section 17(3) Income-tax

Act, 1961

2. Stock Option – – – –

3. Sweat Equity – – – –

4. Commission

- as % of profit – – – –

- others, specify.... – – – –

5. Others, please specify – – – –

Total _ 9,69,514 3,03,992 58,66,047 71,39,553

VII. PENALTIES / PUNISHMENT/ COMPOUNDING OF OFFENCES: NIL

Type Section of Brief Details of Authority Appeal

the Description Penalty / [RD/NCLT/ made, if

Companies Punishment / Court] any (give

Act Compounding details)

fees imposed

A. COMPANY

Penalty – – – – –

Punishment – – – – –

Compounding – – – – –

B. DIRECTORS

Penalty – – – – –

Punishment – – – – –

Compounding – – – – –

C. OTHER OFFICERS IN DEFAULT

Penalty – – – – –

Punishment – – – – –

Compounding – – – – –

25

A Subsidiary of AXIS BANK

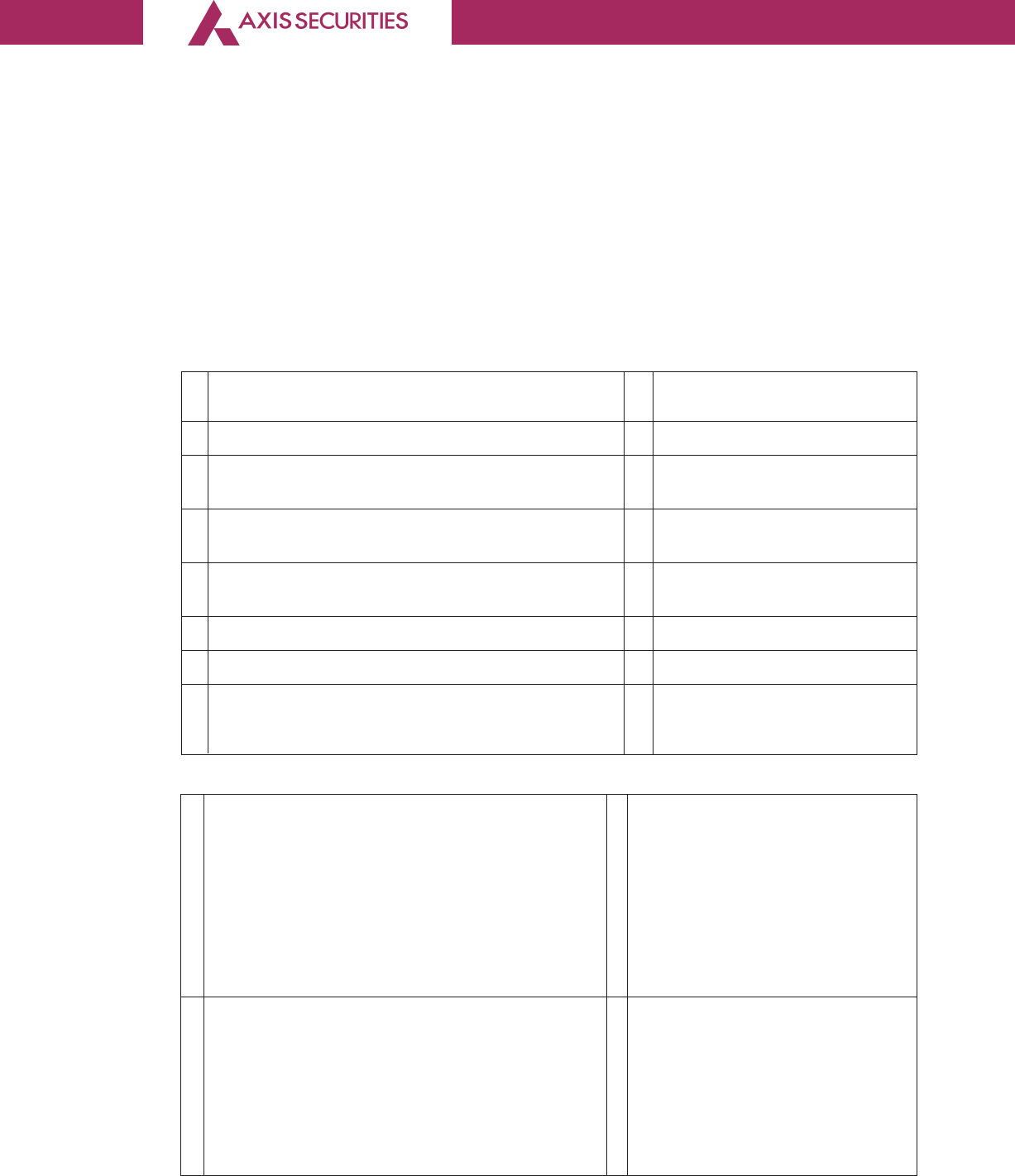

ANNEXURE-B

PARTICULARS OF FOREIGN EXCHANGE OUTFLOWS

Name of the Party Particulars of Purpose Amount of outflow

(in Rupees)

FY 2019-20

Logmein Ireland Limited Membership and subscription 558,499

Screener Membership and subscription 300,000

Apnic Pty Ltd Australia Membership and subscription 90,159

CHART IQ Membership and subscription 544,725

Total 1,493,383

For and on Behalf of the Board of Directors

Pralay Mondal

Chairman

DIN: 00117994

Address: Flat No. 1901 & 1902, Wing E,

Rustomjee Paramount, 18th Road,

Vithaldas Nagar, Khar West, Mumbai 400052

Place : Mumbai

Date : April 23, 2020

26

A Subsidiary of AXIS BANK

ANNEXURE - C

FORM AOC - 2

(Pursuant to Clause (h) of sub-section (3) of Section 134 of the Act and Rule 8(2) of the

Companies (Accounts) Rules, 2014)

Form for disclosure of particulars of contracts/arrangements entered into by the Company with

related parties referred to in sub–section (1) of section 188 of the Companies Act, 2013 including

certain arm’s length transactions under third proviso thereto:

1. Details of contracts or arrangements or transactions not at arm’s length basis

a) Name (s) of the related party and nature of

relationship : NIL

b) Nature of contracts/arrangements/transactions : NIL

c) Duration of the contracts / arrangements /

transactions : NIL

d) Salient terms of the contracts or arrangements

or transactions including the value, if any : NIL

e) Justification for entering into such contracts or

arrangements or transactions : NIL

f) Date(s) of approval by the Board : NIL

g) Amount paid as advances, if any : NIL

h) Date on which the special resolution was passed

in general meeting as required under first proviso : NIL

to Section 188

2. Details of material contracts or arrangement or transactions at arm’s length basis

a) Name (s) of the related party and nature of : 1. Axis Finance Limited

relationship (Group Company)

2. Axis Asset Management

Company Limited (Common

director / Group Company)

3. Axis Bank Limited

(Holding Company)

4. Axis Capital Limited

(Group Company)

b) Nature of contracts/arrangements/transactions : 1. Availing and Rendering of

services

2. Availing and Rendering of

services

3. Availing and Rendering of

services & Sale, Purchase or

supply of any goods or

materials

27

A Subsidiary of AXIS BANK

4. Availing and Rendering of

services

c) Duration of the contracts / arrangements / : 1. Continuous

transactions 2. Continuous

3. Continuous

4. Continuous

d) Salient terms of the contracts or arrangements : 1. Refer Financial statements

or transactions including the value, if any

e) Date (s) of approval by the Board, if any : 12.04.2019 & 18.10.2019

f) Amount paid as advances, if any : NIL

For and on Behalf of the Board of Directors

Pralay Mondal

Chairman

DIN: 00117994

Address: Flat No. 1901 & 1902, Wing E,

Rustomjee Paramount, 18th Road,

Vithaldas Nagar, Khar West, Mumbai 400052

Place : Mumbai

Date : April 23, 2020

28

A Subsidiary of AXIS BANK

ANNEXURE - D

Annual Report on CSR Initiatives Pursuant to Section 135 of the Act & Rules made thereunder

1. Brief Outline of the CSR Policy : The Company’s Corporate Social Responsibility

(CSR) activities reflect its philosophy of helping to

build a better, more sustainable society by taking

into account the societal needs of the Community.

For detailed policy, please refer our

website : www.axissecurities.in

2. The Composition of the CSR : Mr. Ramesh Kumar Bammi – Chairman

Committee Mr. Gop Kumar Bhaskaran – Member

Mr. Jagdeep Mallareddy – Member

Ms. Babu Rao Busi – (Member Independent

Director)

3. Average Net Profit of the : 968,347,370/-

Company for last 3 financial

years

4. The Prescribed CSR expenditure : 1,93,66,947/-

(2% of amount)

5. Details of CSR activities/projects

undertaken during the year :

a. Total amount to be spent : 1,93,66,947/-

for the financial year

b. Amount unspent, if any : NIL

c. Manner in which the amount : Annexure D. 1

spent during the financial year

6. Reason for not spending the : NIL

amount

7. Responsibility statement by the : The CSR Committee confirms that the implemen-

CSR Committee that the CSR tation and monitoring of the CSR Policy, is in

Committee states that the compliance with the CSR objectives and Policy

implementation and monitoring of the Company.

of the CSR Policy, is in compliance

with CSR objectives and Policy of

the Company

29

A Subsidiary of AXIS BANK

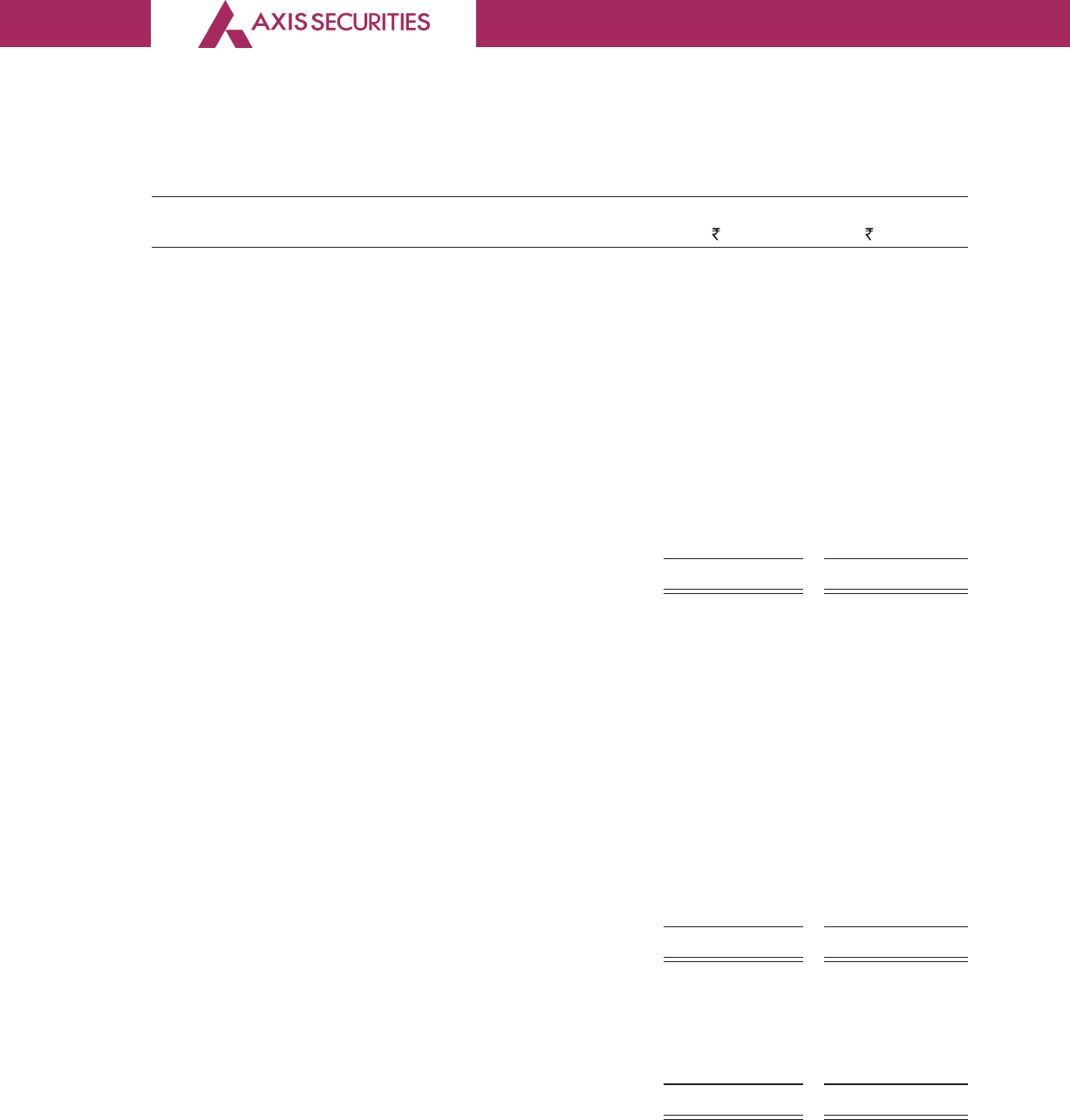

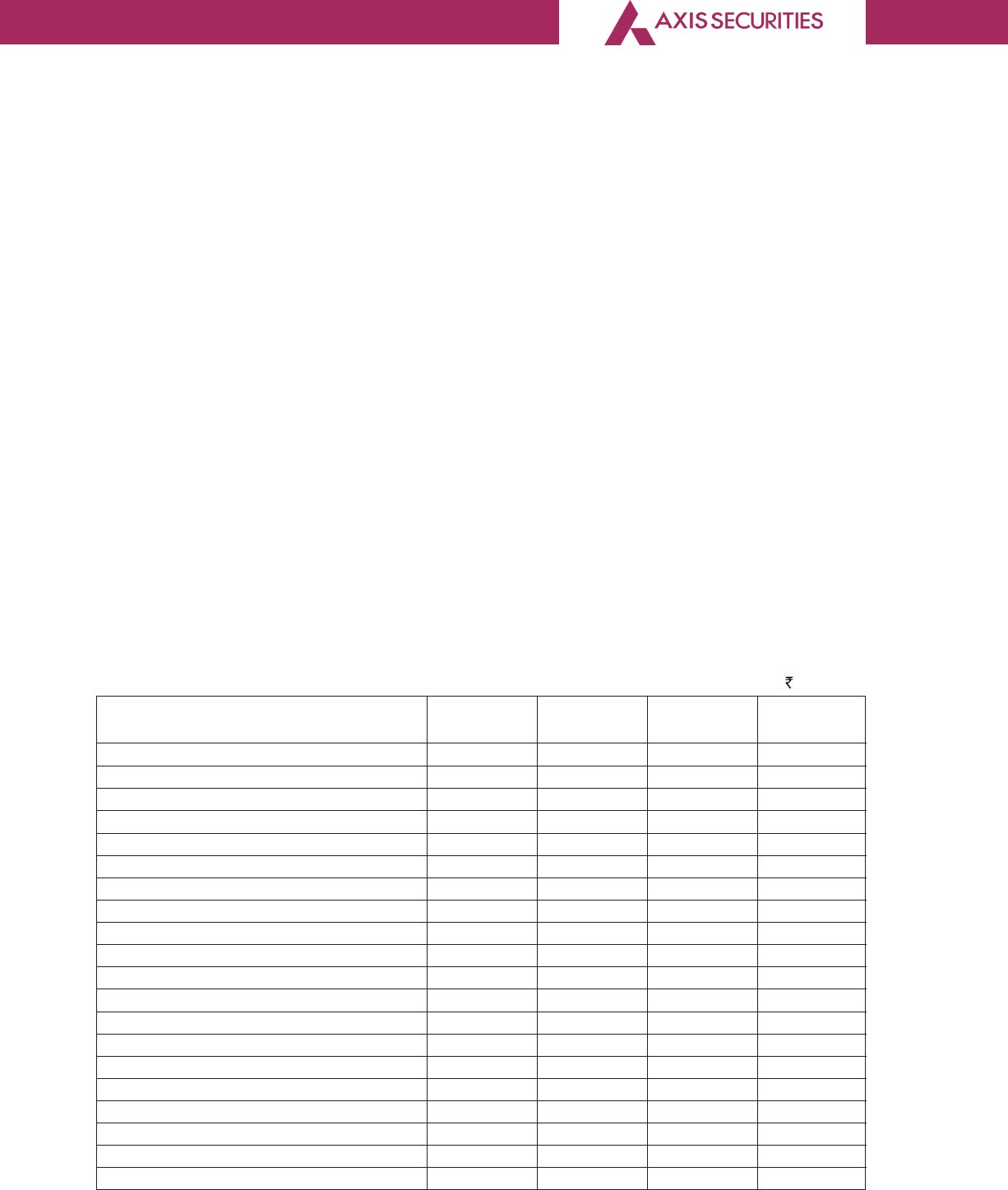

c. Manner in which the amount spent during the financial year is detailed below:

Sr. CSR Project Sector in Projects or Amount Amount Cumulative Amount

No. or activity which the programs (1) outlay spent on expenditure spent :

identified Project is Local area (budget) the projects upto the Direct or

covered or other (2) projects or or programs reporting through

Specify the programs Sub-heads: period implemen-

State and wise (1) Direct ting agency

district where expenditure

projects or on projects

programs or programs

was (2) Overheads

undertaken

1. Rural Livelihood Guwahati 1,93,66,947 1,93,66,947 1,93,66,947

Livelihood enhance- Through

mission- ment implementing

Kabil projects agency

Ramesh Kumar Bammi Gopkumar Bhaskaran

Chairman, CSR Committee Managing Director & CEO

DIN: 03411046 DIN: 07223999

Address: S 285, Third Floor, Address: Flat No. 1303/13 Floor,

Greater Kailash, D Wing, RNA Continental,

Part 2, New Delhi 110048 Chembur East, Mumbai - 400071

Place : New Delhi Place : Mumbai

Date : April 23, 2020 Date : April 23, 2020

ANNEXURE - D1

30

A Subsidiary of AXIS BANK

ANNEXURE - E

Form No. MR-3

SECRETARIAL AUDIT REPORT

FOR THE FINANCIAL YEAR ENDED MARCH 31, 2018

[Pursuant to Section 204(1) of the Companies Act, 2013 and Rule no. 9 of the Companies

(Appointment and Remuneration of Managerial Personnel) Rules, 2014]

To

The Members,

Axis Securities Limited

We have conducted a Secretarial Audit of the compliance of applicable statutory provisions and

the adherence to good corporate practices by Axis Securities Limited. CIN No-

U74992MH2006PLC163204 (hereinafter called the ‘Company’) during the financial year from 1

st

April 2019 to 31

st

March 2020, (‘the year’/ ‘audit period’/ ‘period under review’).

We conducted the Secretarial Audit in a manner that provided us a reasonable basis for evaluating

the company’s corporate conducts/statutory compliances and expressing our opinion thereon.

We are issuing this report based on :

(i) our verification of the books, papers, minute books, soft copy as provided by the company

and other records maintained by the company and furnished to us, forms/ returns filed and

compliance related action taken by the company during the financial year ended 31

st

March

2020 as well as before the issue of this report,

(ii) Our observations shared during our visits to the Corporate office of the Company,

(iii) Compliance Certificates confirming Compliance with all laws applicable to the company

given by Key Managerial Personnel / senior managerial Personnel of the company and taken

on record by Audit Committee / Board of Directors,and

(iv) Representations made, documents shown and information provided by the company, its

officers, agents, and authorised representatives during our conduct of secretarial Audit.

We hereby report that in our opinion, during the audit period covering the financial year ended on

31

st

March 2020 the Company has:

(i) complied with the statutory provisions listed hereunder, and

(ii) Board-processes and compliance mechanism are in place to the extent, in the manner and

subject to the reporting made hereinafter.

31

A Subsidiary of AXIS BANK

The members are requested to read this report along with our letter of even date annexed to this

report as Annexure - A.

1. Compliance with specific statutory provisions

We further report that:

1.1 We have examined the books, papers, minute books and other records maintained by the

Company and the forms, returns, reports, disclosures and information filed or disseminated

during the year according to the applicable provisions/clauses of:

(i) The Companies Act, 2013 and the Rules made thereunder;

(ii) The Securities Contracts (Regulation) Act, 1956 and the Rules made thereunder;

(iii) The Depositories Act, 1996 and the Regulations and Bye-laws framed thereunder;

(iv) The following Regulations Guidelines prescribed under the Securities and Exchange Board

of India Act, 1992 (‘SEBI Regulations’):

(a) The Securities and Exchange Board of India (Prohibition of Insider Trading)

Regulations, 2015; and

(b) The Securities and Exchange Board of India (Registrars to an Issue and Share Transfer

Agents) Regulations, 1993 regarding the Companies Act,2013 and dealing with

client

(c) The Securities and Exchange Board of India (Stock Brokers) Regulations, 1992;

(d) The Securities and Exchange Board of India (Research Analysts) Regulations, 2014;

(e) The Securities and Exchange Board of India (Portfolio Managers) Regulation, 1993.

(v) Secretarial Standards issued by The Institute of Company Secretaries of India(Secretarial

standards).

1.2 During the period under review, and also considering the compliance related action taken

by the company after 31

st

March, 2020 but before the issue of this report, the company has, to

the best of our knowledge and belief and based on the records, information, explanations

and representations furnished to us :

(i) Complied with the applicable provisions/clauses of the Act, Rules, SEBI Regulations and

Agreements mentioned under of paragraph 1.1

32

A Subsidiary of AXIS BANK

(ii) Generally complied with the applicable provisions/ clauses of :

(a) TheAct and rules mentioned under paragraph 1.1 (i);

(b) The Secretarial standards on meetings of the Board of Directors (SS-1) and Secretarial

standards on General Meetings (SS-2) mentioned under paragraph 1.1 (vi) above

to the extent applicable to Board meetings held during the year, the 13

th

Annual

General Meeting held on 7

th

June 2019 and Extra Ordinary General Meeting held

on September 25, 2019 and January 8, 2020 and the resolution passed by

circulation.The Compliance of the provisions of the Rules made under the Act

[paragraph 1.1(i)] and SS-1 [paragraph 1.1(vi) with regard to the Board meetings

held through video conferencing on various dates were verified based on the

minutes of the meetings , shown to us , by the company.

1.3 We are informed that, during the year, the company was not required to initiate any

compliance related action in respect of the following laws/rules/regulations/standards, and

was consequently not required to maintain any books, papers, minute books or other records

or file any form/returns thereunder:

(i) The Securities and Exchange Board of India (Substantial Acquisition of Shares and

Takeovers) Regulations, 2011;

(ii) The Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements)

Regulations, 2009;

(iii) The Securities and Exchange Board of India (Listing Obligations and Disclosure

Requirements) Regulations, 2015;

(iv) The Securities and Exchange Board of India (Share Based Employee Benefits) Regulations,

2014;

(v) The Securities and Exchange Board of India (Issue and Listing of Debt Securities)

Regulations, 2008;

(vi) The Securities and Exchange Board of India (Delisting of Equity Shares) Regulations, 2009;

(vii) The Securities and Exchange Board of India (Buyback of Securities) Regulations, 1998; and

(viii) Foreign Exchange Management Act, 1999 and the Rules and Regulations made

thereunder to the extent of Foreign Direct Investment, Overseas Direct Investment and

External Commercial Borrowings;

1.4 There was no other law that was specifically applicable to the company, considering the

nature of its business. Hence the requirement to report on compliance with any other specific

law under paragraphs 1.1 and 1.2 above did not arise.

33

A Subsidiary of AXIS BANK

2. Board processes:

We further report that:

2.1 The Board of Directors of Company as on 31

st

March, 2020 comprised of:

(i) Two Executive Director,

(ii) Three Non-Executive Non Independent Director, and

(iii) Two Non-Executive Independent Directors, including a woman Independent Director

2.2 The processes relating to the following changes in the composition of the board of Directors

during the year were carried out in compliance with the provisions of the Act :

(i) Re-appointment of Mr Arun Thukral (DIN:03043072) as MD & CEO for term of three years

from May 25, 2019 to May 24, 2022 was approved at board meeting held on April 12,

2019.

(ii) Appointment of Mr Pralay Mondal (DIN: 00117994 ) as Additional Director of the company

was approved at the board meeting held on held on April 12, 2019 and the appointment

was regularised at 13

th

AGM

(iii) Resignation of Ms Nithya Eswaran(DIN:03605392), ID of the company was received on

April 12, 2019

(iv) Resignation of Mr Rajiv Anand(DIN:02541753) as Director of the company was accepted

by company on May 9, 2019 & Noted by passing circular resolution on May 13, 2019

(v) Resignation of Ms Lovelina Faroz, Company Secretary of the company was received by

the company on July 30, 2019 and was effective from October 29, 2019

(vi) Appointment of Ms Bhumika Batra (DIN: 03502004) as additional director(Independent)

of the company was approved at the board meeting held on July 16, 2019 and the

appointment was regularised at the Extra-ordinary General Meeting held on January 8,

2020

(vii) Re-appointment Mr Jagdeep Mallareddy (DIN: 07492539 ) as Director retiring by rotation

at 13

th

AGM,

(viii) Appointment of Mr. Gopkumar Bhaskaran (DIN:07223999 ) as MD & CEO for term starting

from January 1, 2020 to December 31, 2022 was approved at board meeting held on

October 18, 2019 and was approved by the shareholders at the Extra-ordinary General

Meeting held on January 8, 2020

34

A Subsidiary of AXIS BANK

(ix) Resignation of Mr Arun Thukral (DIN:03043072 ) as MD & CEO with effect from December

31, 2019 was taken on record at the board meeting held on October 18, 2019.

(x) Re-appointment of Mr Anand Kumar Saha (DIN: 02421213) as WTD & KMP for term of

three years from March 1, 2020 to February 28, 2023 was approved at board meeting

held on January 15, 2020

(xi) Appointment of Ms Divya Poojari as Company Secretary was approved by board of

directors at the board meeting held on January 15, 2020 and was effective from January

30, 2020

2.3 Adequate notice was given to all the directors to enable them to plan their schedule for the

Board meetings, except for one meeting which was convened at a shorter notice to transact

urgent business.

2.4 Notice of Board meetings was sent to directors at least seven days in advance as required

under Section 173(3) of the Act and SS-1.

2.5 Agenda and detailed notes on agenda were sent to the directors at least seven days before

the board meetings.

2.6 Agenda and detailed notes on agenda for the following items were either circulated

separately less than seven days before or at the Board meetings and consent of the Board for

so circulating them was duly obtained as required under SS-1:

(i) Supplementary agenda notes and annexures in respect of unpublished price sensitive

information such as audited financial statement/results, unaudited financial results and

connected papers, and

(ii) Additional subjects/information/presentations and supplementary notes.

2.7 A system exists for directors to seek and obtain further information and clarifications on the

agenda items before the meetings and for their meaningful participation at the meetings.

2.8 We note from the minutes verified that, at the Board meetings held during the year:

(i) Majority decisions were carried through; and

(ii) No dissenting views were expressed by any Board member on any of the subject matters

discussed, that were required to be captured and recorded as part of the minutes.

3. Compliance mechanism

There are reasonably adequate systems and processes in the company, commensurate with

the company’s size and operations, to monitor and ensure compliance with applicable laws,

35

A Subsidiary of AXIS BANK

rules, regulations and guidelines. There is scope for further improvement in the compliance

systems and processes, Commensurate with the increasing statutory requirements and growth

in operations.

4. Specific events/ actions

4.1 During the year, the following specific events/ actions having a major bearing on the

company’s affairs took place, in pursuance of the above referred laws, rules, regulations and

standards:

(i) Approval of members was accorded by way of ordinary resolution passed at Extra

Ordinary General Meeting held on September 25, 2019 to Increase the Authorised Share

Capital of the company from 150 crore to 250 crore

(ii) Approval of members was accorded by way of special resolution passed at Extra Ordinary

General Meeting held on September 25, 2019 for Alteration of Memorandum of

Association& Alteration of Association.

For BNP & Associates

Company Secretaries

B. Narasimha

Place : Mumbai Partner

Date : 30.04.2020 FCS 1303/C.P. No. 10440

Peer Review No-637/2019

UDIN- F001303B000190151

Firm Reg No-P2014MH037400

Note: This report is to be read with our letter of even date which is annexed as Annexure A and

forms an integral part of this report.

36

A Subsidiary of AXIS BANK

Annexure A

To,

The Members,

Axis Securities Limited

Secretarial Audit Report of even date is to be read along with this letter.

1. The Company’s management is responsible for maintenance of secretarial records and

compliance with the provisions of corporate and other applicable laws, rules, regulations

and standards. Our responsibility is to express an opinion on the secretarial records produced

for our audit.

2. We have followed such audit practices and processes as we considered appropriate to obtain

reasonable assurance about the correctness of the contents of the secretarial records.

3. While forming an opinion on compliance and issuing this report, we have also considered

compliance related action taken by the company after 31

st

March 2020 but before the issue

of this report.

4. we have considered compliance related actions taken by the company based on

independent legal /professional opinion obtained as being in compliance with law.

5. We have verified the secretarial records furnished to us on a test basis to see whether the

correct facts are reflected therein. We also examined the compliance procedures followed

by the company on a test basis. We believe that the processes and practices we followed,

provides a reasonable basis for our opinion.

6. We have not verified the correctness and appropriateness of financial records and Books of

Accounts of the Bank.

7. we have obtained the management’s representation about the compliance of laws, rules

and regulations and happening of events, wherever required.

8. Our Secretarial Audit Report is neither an assurance as to the future viability of the Bank nor of

the efficacy or effectiveness with which the management has conducted the affairs of the

Company.

For BNP & Associates

Company Secretaries

B. Narasimha

Place : Mumbai Partner

Date : 30.04.2020 FCS 1303/C.P. No. 10440

Peer Review No-637/2019

UDIN- F001303B000190151

Firm Reg No-P2014MH037400

37

A Subsidiary of AXIS BANK

INDEPENDENT AUDITORS’ REPORT

To the Members of Axis Securities Limited

Report on the Financial Statements

Opinion

We have audited the accompanying Ind AS financial statements of Axis Securities Limited (“the

Company”), which comprise the Balance sheet as at March 31 2020, the Statement of Profit and

Loss, including the statement of Other Comprehensive Income, the Cash Flow Statement and

the Statement of Changes in Equity for the year then ended, and notes to the financial statements,

including a summary of significant accounting policies and other explanatory information.

In our opinion and to the best of our information and according to the explanations given to us,

the aforesaid Ind AS financial statements give the information required by the Companies

Act, 2013, as amended (“the Act”) in the manner so required and give a true and fair view in

conformity with the accounting principles generally accepted in India, of the state of affairs of

the Company as at March 31, 2020, its profitincluding other comprehensive income, its cash flows

and the changes in equity for the year ended on that date.

Basis for Opinion

We conducted our audit of the Ind AS financial statements in accordance with the Standards on

Auditing (SAs),as specified under section 143(10) of the Act. Our responsibilities under those

Standards are further described in the ‘Auditor’s Responsibilities for the Audit of theInd AS Financial

Statements’ section of our report. We are independent of the Company in accordance with the

‘Code of Ethics’ issued by the Institute of Chartered Accountants of India together with the ethical

requirements that are relevant to our audit of the financial statements under the provisions of the

Act and the Rules thereunder, and we have fulfilled our other ethical responsibilities in accordance

with these requirements and the Code of Ethics. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our audit opinion on the Ind AS financial

statements.

Other Information

The Company’s Board of Directors is responsible for the other information. The other information

comprises the information included in the Annualreport,but does not include the Ind AS financial

statements and our auditor’s report thereon.

Our opinion on the Ind AS financial statements does not cover the other information and we do

not express any form of assurance conclusion thereon.

In connection with our audit of the Ind AS financial statements, our responsibility is to read the

other information and, in doing so, consider whether such other information is materially inconsistent

with the financial statements or our knowledge obtained in the audit or otherwise appears to be

materially misstated. If, based on the work we have performed, we conclude that there is a

material misstatement of this other information, we are required to report that fact. We have

nothing to report in this regard.

Responsibilities of Management for the Ind AS Financial Statements

The Company’s Board of Directors is responsible for the matters stated in Section 134(5) of the Act

with respect to the preparation of these Ind ASfinancial statements that give a true and fair view

of the financial position, financial performance including other comprehensive income, cash

38

A Subsidiary of AXIS BANK

flows and changes in equity of the Company in accordance with the accounting principles

generally accepted in India, including the Indian Accounting Standards (Ind AS) specified under

section 133 of the Act, read with the Companies (Indian Accounting Standards) Rules, 2015, as

amended. This responsibility also includes maintenance of adequate accounting records in

accordance with the provisions of the Act for safeguarding of the assets of the Company and for

preventing and detecting frauds and other irregularities; selection and application of appropriate

accounting policies; making judgments and estimates that are reasonable and prudent; and the

design, implementation and maintenance of adequate internal financial controls, that were

operating effectively for ensuring the accuracy and completeness of the accounting records,

relevant to the preparation and presentation of the Ind AS financial statements that give a true

and fair view and are free from material misstatement, whether due to fraud or error.

In preparing the Ind AS financial statements, management is responsible for assessing the

Company’s ability to continue as a going concern, disclosing, as applicable, matters related to

going concern and using the going concern basis of accounting unless management either intends

to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those Board of Directors are also responsible for overseeing the Company’s financial reporting

process.

Auditor’s Responsibilities for the Audit of the Ind AS Financial Statements

Our objectives are to obtain reasonable assurance about whether the Ind AS financial statements

as a whole are free from material misstatement, whether due to fraud or error, and to issue an

auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but

is not a guarantee that an audit conducted in accordance with SAs will always detect a material

misstatement when it exists. Misstatements can arise from fraud or error and are considered material

if, individually or in the aggregate, they could reasonably be expected to influence the economic

decisions of users taken on the basis of these Ind AS financial statements.

As part of an audit in accordance with SAs, we exercise professional judgment and maintain

professional skepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the Ind AS financial statements, whether

due to fraud or error, design and perform audit procedures responsive to those risks, and

obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The

risk of not detecting a material misstatement resulting from fraud is higher than for one resulting

from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or

the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances. Under section 143(3)(i) of the Act, we

are also responsible for expressing our opinion on whether the Company has adequate internal

financial controls system in place and the operating effectiveness of such controls.

• Evaluate the appropriateness of accounting policies used and the reasonableness of

accounting estimates and related disclosures made by management.

• Conclude on the appropriateness of management’s use of the going concern basis of

accounting and, based on the audit evidence obtained, whether a material uncertainty

39

A Subsidiary of AXIS BANK

exists related to events or conditions that may cast significant doubt on the Company’s ability

to continue as a going concern. If we conclude that a material uncertainty exists, we are

required to draw attention in our auditor’s report to the related disclosures in the financial

statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are

based on the audit evidence obtained up to the date of our auditor’s report. However, future

events or conditions may cause the Company to cease to continue as a going concern.

• Evaluate the overall presentation, structure and content of the Ind AS financial statements,

including the disclosures, and whether the Ind AS financial statements represent the underlying

transactions and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the

planned scope and timing of the audit and significant audit findings, including any significant

deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with

relevant ethical requirements regarding independence, and to communicate with them all

relationships and other matters that may reasonably be thought to bear on our independence,

and where applicable, related safeguards.

Report on Other Legal and Regulatory Requirements

1. As required by the Companies (Auditor’s Report) Order, 2016 (“the Order”), issued by the

Central Government of India in terms of sub-section (11) of Section 143 of the Act, we give in

the “Annexure 1” a statement on the matters specified in paragraphs 3 and 4 of the Order.

2. As required by Section 143(3) of the Act, we report that:

(a) We have sought and obtained all the information and explanations which to the best of

our knowledge and belief were necessary for the purposes of our audit;

(b) In our opinion, proper books of account as required by law have been kept by the

Company so far as it appears from our examination of those books;

(c) The Balance Sheet, the Statement of Profit and Loss including the Statement of Other

Comprehensive Income, the Cash Flow Statement and Statement of Changes in Equity

dealt with by this Report are in agreement with the books of account;

(d) In our opinion, the aforesaid Ind AS financial statements comply with the Accounting

Standards specified under Section 133 of the Act, read with Companies (Indian

Accounting Standards) Rules, 2015, as amended;

(e) On the basis of the written representations received from the directors as on March 31,

2020 taken on record by the Board of Directors, none of the directors is disqualified as on

March 31, 2020 from being appointed as a director in terms of Section 164 (2) of the Act;

40

A Subsidiary of AXIS BANK

(f) With respect to the adequacy of the internal financial controls over financial reporting

of the Company with reference to these Ind AS financial statements and the operating

effectiveness of such controls, refer to our separate Report in “Annexure 2” to this report;

(g) In our opinion, the managerial remuneration for the year ended March 31, 2020 has

been paid by the Company to its directors in accordance with the provisions of section

197 read with Schedule V to the Act;

(h) With respect to the other matters to be included in the Auditor’s Report in accordance

with Rule 11 of the Companies (Audit and Auditors) Rules, 2014, as amended in our

opinion and to the best of our information and according to the explanations given to

us:

i. The Company has disclosed the impact of pending litigations on its financial position

in its Ind AS financial statements – Refer Note 34 to theInd AS financial statements;

ii. The Company did not have any long-term contracts including derivative contracts