Summary of Selected Findings – Nevada Home Insurance Wildfire Data Call – Expanded Version

Nevada Division of Insurance – Property and Casualty Advisory Committee Meeting of November 15, 2023

1

Note: This information represents the Nevada home insurance market through December 31, 2022.

A review of the change in policies from 2021 to 2022 in ZIP Codes where policies were cancelled or

nonrenewed due to wildfire risk shows an increase in availability in 26 ZIP Codes and reduced

availability in 11 ZIP Codes.

O

verall, the change in the market from 2021 to 2022 is a 1.52% increase of availability of

homeowners’ insurance coverage in the wildfire-prone areas.

All ZIP Codes considered wildfire-prone that showed a reduced availability from 2021 to 2022 had a

decrease in availability of 5.5% or less, with the exception of ZIP Code 89450, Incline Village in

Washoe County, which showed a 12.39% decrease in availability.

Z

IP Code 89413, Glenbrook in Douglas County, had the highest percentage of applications not

accepted due to wildfire risk at 14.3% of all total applications (421 applications) in 2022. This ZIP

Code also experienced a slight decrease in availability of 1.32%, from 530 policies in 2021 to 523 in

2022.

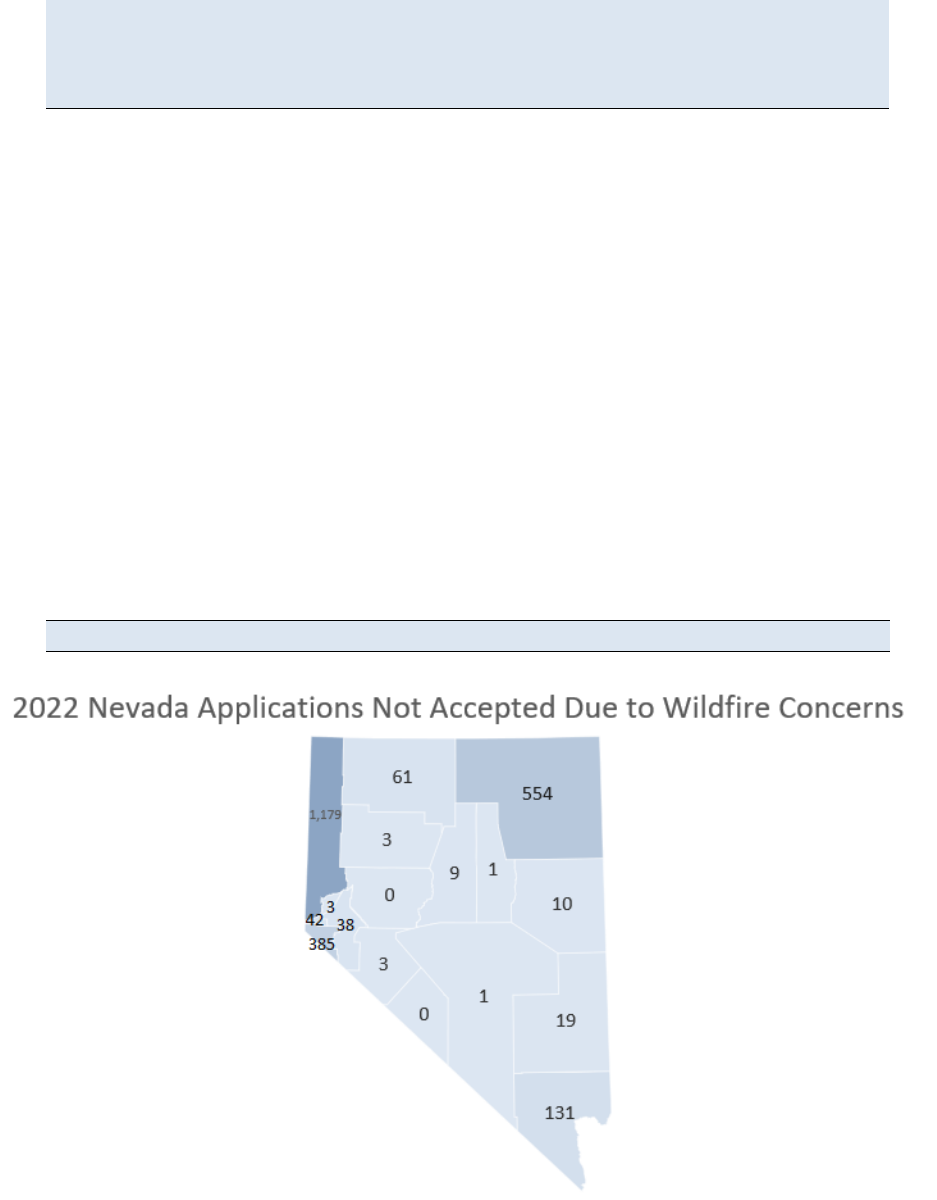

In 2022, insurers reported 2,439 applications in 90 different ZIP Codes that were not accepted due to

concerns regarding wildfire risk. This represents 0.15% of the total applications of 1,602,266 and

0.25% of the 985,704 applications that were not accepted for any reason.

There were also 265 policies that were cancelled or non-renewed by insurers in 2022 due to concerns

related to wildfire risk. This accounts for 0.2% of the 115,365 policies cancelled or non-renewed by

insurers for any reason and 0.03% of the total 2021 policies of 973,200.

Top 5 ZIP Codes with Greatest Number of Applications Not Accepted for Wildfire-Related Reasons in 2022

ZIP Code

City / County

Total

Applications

Not Accepted for

Wildfire

Reasons

% of Total Not

Accepted for

Wildfire Reasons

89815

Spring Creek / Elko

8,794

334

3.8%

89451

Incline Village / Washoe

3,864

259

6.7%

89801

Elko / Elko

11,356

206

1.8%

89511

Southwest Reno / Washoe

14,213

192

1.4%

89508

Reno / Washoe

4,759

138

2.9%

Top 5 ZIP Codes with Highest Percentage of Applications Not Accepted for Wildfire-Related Reasons in 2022

ZIP Code

City / County

Total

Applications

Not Accepted for

Wildfire

Reasons

% of Total Not

Accepted for

Wildfire Reasons

89413

Glenbrook / Douglas

421

60

14.3%

89831

Mountain City / Elko

9

1

11.1%

89124

Mount Charleston / Clark

551

47

8.5%

89451

Incline Village / Washoe

3,864

259

6.7%

89449

Stateline / Douglas

1,520

100

6.6%

Summary of Selected Findings – Nevada Home Insurance Wildfire Data Call – Expanded Version

Nevada Division of Insurance – Property and Casualty Advisory Committee Meeting of November 15, 2023

2

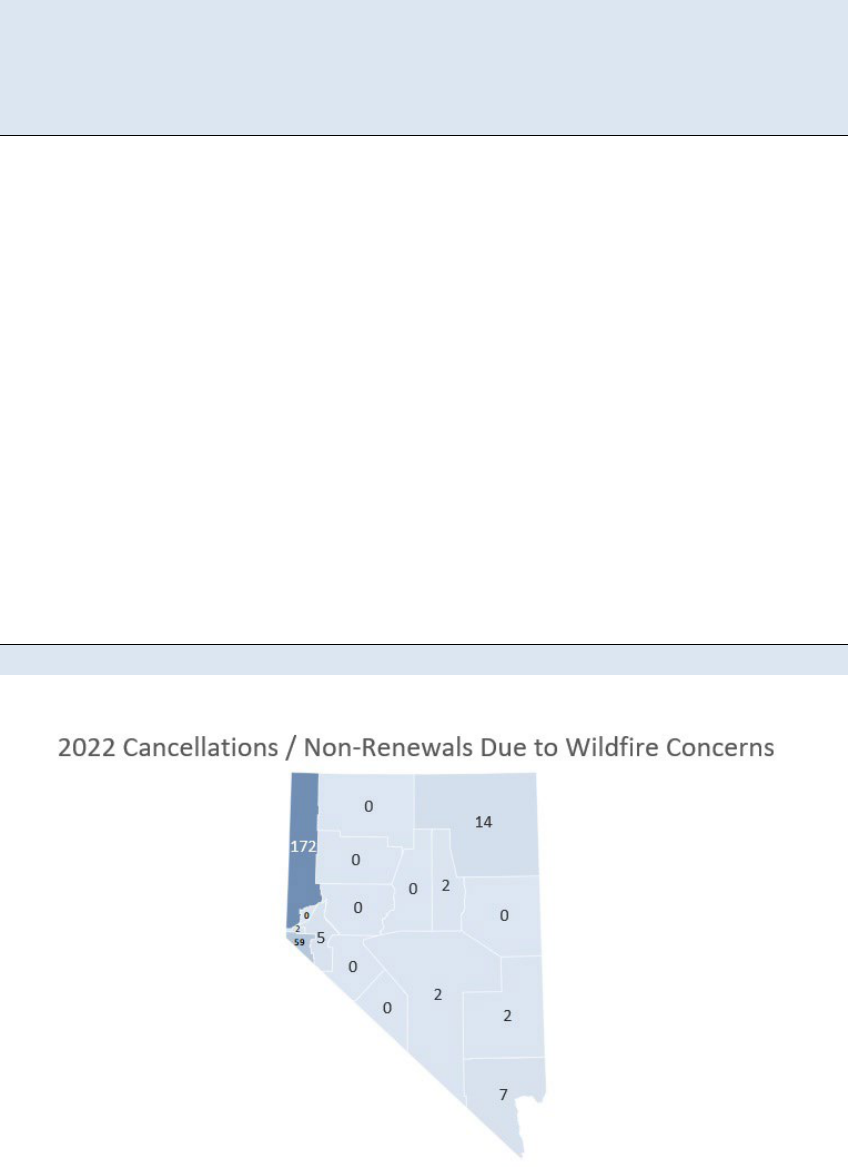

265 policies were cancelled or nonrenewed by any insurer in 2022 due to reasons related to wildfire

risk. Washoe County was the most affected with 172 total policies nonrenewed due to wildfire risk, for

64.9% of the total. Douglas County was the second most affected, with 59 policies nonrenewed, for

22.3% of the total. Elko County was the third most affected, with 14 policies nonrenewed, for 5.3% of

the total. Clark County had 7 policies nonrenewed, for 2.6% of the total, and Lyon County had 5 policies

nonrenewed, for 1.9% of the total. Carson City, Nye, Lincoln, and Eureka Counties each had 2 policies

nonrenewed, for 0.8% of the total.

37 ZIP Codes, or 14.6% of all ZIP codes, had policies cancelled or nonrenewed by the insurer in

2022 due to wildfire risk. These include:

Zip City County Policies Cancelled/Nonrenewed Due to Wildfire Risk

89451 Incline Village Washoe County 71

89511 Reno Washoe County 40

89413 Glenbrook Douglas County 21

89506 Reno Washoe County 15

89448 Zephyr Cove Douglas County 13

89521 Reno Washoe County 13

89410 Gardnerville Douglas County 8

89449 Stateline Douglas County 8

89801 Elko Elko County 8

89508 Reno Washoe County 6

89402 Crystal Bay Washoe County 5

89403 Dayton Lyon County 5

89815 Spring Creek Elko County 5

89460 Gardnerville Douglas County 4

89510 Reno Washoe County 4

89523 Reno Washoe County 4

89704 Washoe Valley Washoe County 4

89124 Las Vegas Clark County 3

89436 Sparks Washoe County 3

89135 Las Vegas Clark County 2

89316 Eureka Eureka County 2

89411 Genoa Douglas County 2

89450 Incline Village Washoe County 2

89519 Reno Washoe County 2

89703 Carson City Carson City 2

89705 Carson City Douglas County 2

89008 Caliente Lincoln County 1

89020 Amargosa Valley Nye County 1

89040 Overton Clark County 1

89043 Pioche Lincoln County 1

89048 Pahrump Nye County 1

89103 Las Vegas Clark County 1

89434 Sparks Washoe County 1

89439 Verdi Washoe County 1

89444 Wellington Douglas County 1

89503 Reno Washoe County 1

89831 Mountain City Elko County 1

Summary of Selected Findings – Nevada Home Insurance Wildfire Data Call – Expanded Version

Nevada Division of Insurance – Property and Casualty Advisory Committee Meeting of November 15, 2023

3

Underwriting Criteria – Selected Statistics

Scoring Models

50.5% of the responding insurers use a scoring model to assess wildfire risk in underwriting.

Underwriting Characteristics

Multiple property characteristics were provided that insurers use in making an underwriting decision.

These include:

i. Roof type, with wood roofs being ineligible or facing higher scrutiny.

ii. Location of the property and accessibility of year-round firefighting equipment.

iii. Vegetation management and defensible space.

iv. Construction characteristics of property, siding, roof covering, flame, and ember-resistant venting,

outbuildings, etc.

v. Unacceptable loss history.

Mitigation

44.2% of the responding insurers indicated that individual wildfire risk mitigation taken by the

policyholder was considered in the underwriting decision. Only 5.2% of the responding insurers

indicated that community wildfire risk mitigation was a consideration in the underwriting decision.

Summary of Selected Findings – Nevada Home Insurance Wildfire Data Call – Expanded Version

Nevada Division of Insurance – Property and Casualty Advisory Committee Meeting of November 15, 2023

4

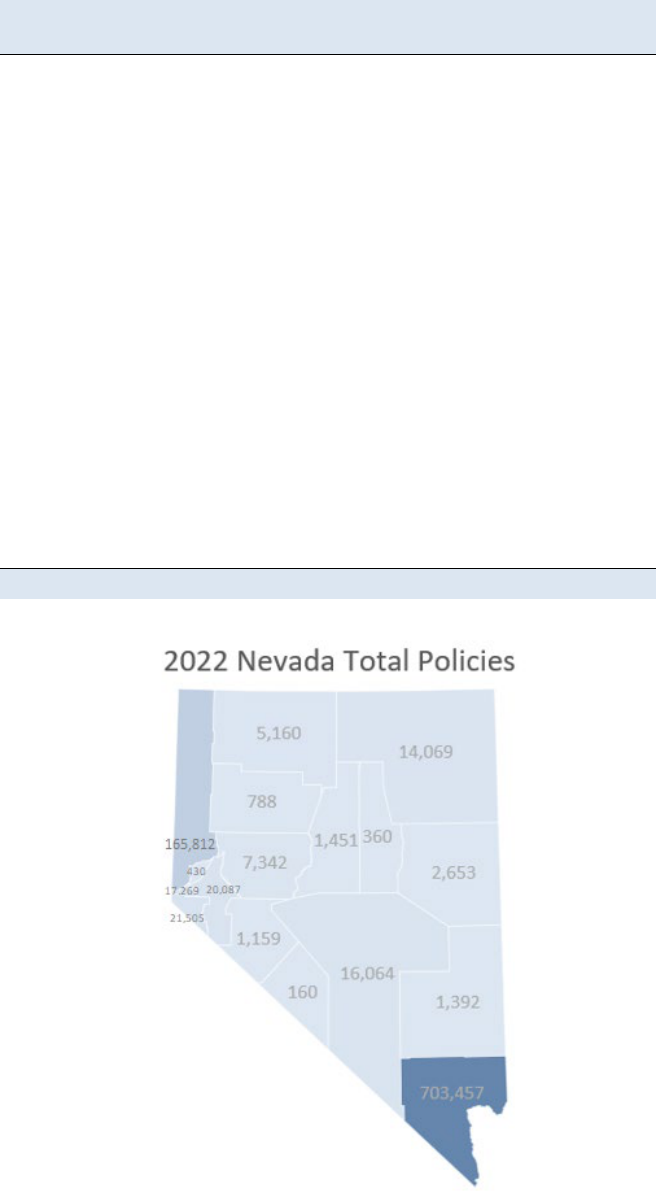

EXHIBIT 1

2021-2022 HOME INSURANCE POLICIES BY COUNTY

County

Policies in

2021

Policies in

2022

Change

Clark County

702,137

703,457

1,320

Washoe County

162,255

165,812

3,557

Douglas County

21,418

21,505

87

Lyon County

18,888

20,087

1,199

Carson City

18,157

17,269

-888

Nye County

15,964

16,064

100

Elko County

13,729

14,069

340

Churchill County

7,215

7,342

127

Humboldt County

5,087

5,160

73

White Pine County

2,620

2,653

33

Lander County

1,460

1,451

-9

Lincoln County

1,372

1,392

20

Mineral County

1,158

1,159

1

Pershing County

803

788

-15

Storey County

415

430

15

Eureka County

356

360

4

Esmeralda County

166

160

-6

Grand Total

973,200

979,158

5,958

Summary of Selected Findings – Nevada Home Insurance Wildfire Data Call – Expanded Version

Nevada Division of Insurance – Property and Casualty Advisory Committee Meeting of November 15, 2023

5

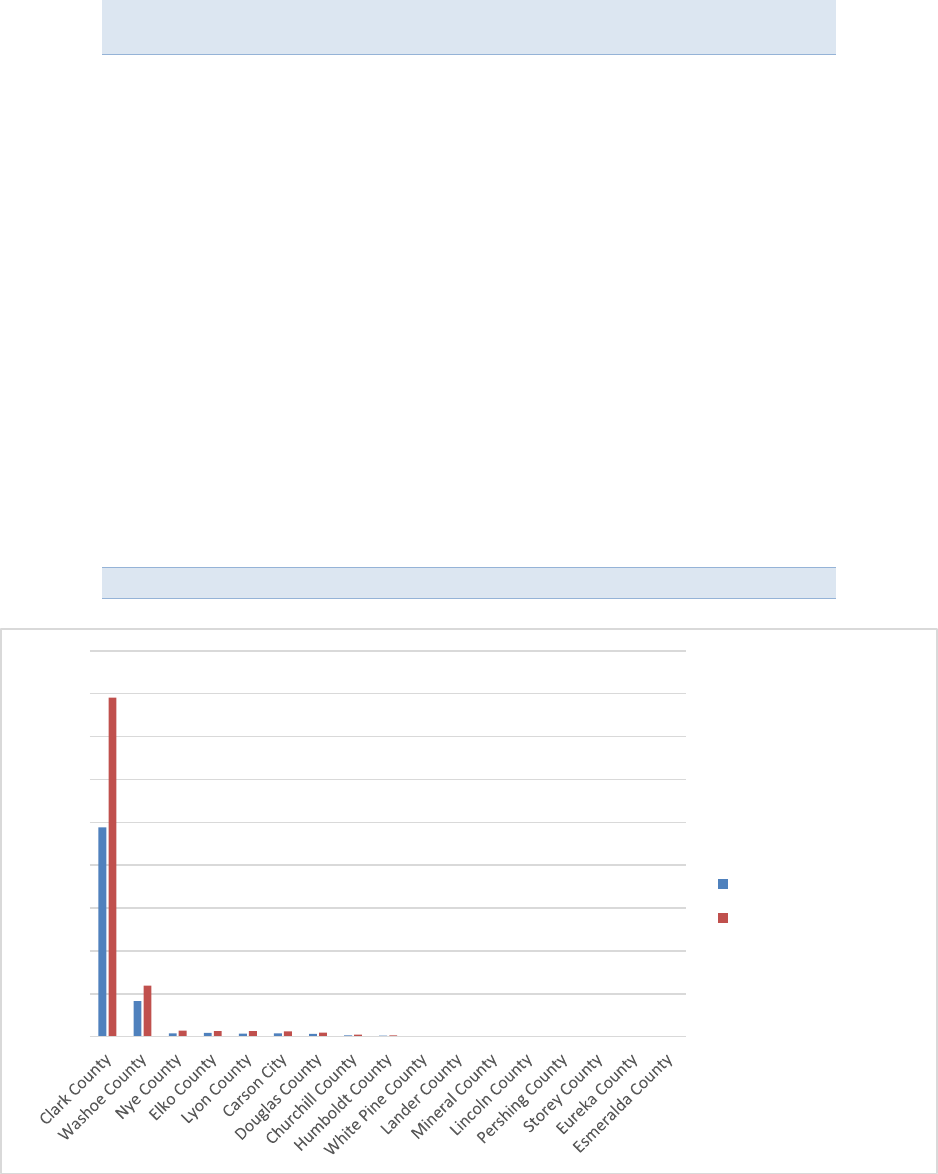

EXHIBIT 2

2022 Home Insurance Applications by County

County

Total Applications in

2022

Clark County

1,278,465

Washoe County

201,524

Elko County

22,392

Nye County

21,925

Lyon County

20,474

Carson City

20,228

Douglas County

16,375

Churchill County

7,180

Humboldt County

5,675

White Pine County

2,445

Lander County

1,625

Mineral County

1,189

Lincoln County

1,171

Pershing County

734

Storey County

394

Eureka County

342

Esmeralda County

128

Grand Total

1,602,266

Total

Clark County

Washoe County

Elko County

Nye County

Lyon County

Carson City

Douglas County

Churchill County

Humboldt County

Summary of Selected Findings – Nevada Home Insurance Wildfire Data Call – Expanded Version

Nevada Division of Insurance – Property and Casualty Advisory Committee Meeting of November 15, 2023

6

EXHIBIT 3

2022 Home Insurance Applications Accepted / Not Accepted (For Any Reason)

County

Applications Accepted

in 2022

Applications Not Accepted

in 2022

Clark County

488,175

790,290

Washoe County

82,818

118,706

Nye County

7,457

14,468

Elko County

9,023

13,369

Lyon County

7,170

13,304

Carson City

7,565

12,663

Douglas County

6,445

9,930

Churchill County

2,762

4,418

Humboldt County

2,440

3,235

White Pine County

886

1,559

Lander County

467

1,158

Mineral County

358

831

Lincoln County

447

724

Pershing County

250

484

Storey County

151

243

Eureka County

121

221

Esmeralda County

27

101

Grand Total

616,562

985,704

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

Apps Accepted 2022

Apps Not Accepted 2022

Summary of Selected Findings – Nevada Home Insurance Wildfire Data Call – Expanded Version

Nevada Division of Insurance – Property and Casualty Advisory Committee Meeting of November 15, 2023

7

EXHIBIT 4

2022 Home Insurance Applications Not Accepted Due to Wildfire Risk Concerns

County

Total

Applications in

2022

Applications Not

Accepted in 2022

Due to Wildfire Risk

Concerns

Applications Not Accepted

in 2022 Due to Wildfire Risk

Concerns as a Percentage of

Total Applications

Washoe County

201,524

1,179

0.6%

Elko County

22,392

554

2.5%

Douglas County

16,375

385

2.4%

Clark County

1,278,465

131

0.0%

Humboldt County

5,675

61

1.1%

Carson City

20,228

42

0.2%

Lyon County

20,474

38

0.2%

Lincoln County

1,171

19

1.6%

White Pine County

2,445

10

0.4%

Lander County

1,625

9

0.6%

Storey County

394

3

0.8%

Pershing County

734

3

0.4%

Mineral County

1,189

3

0.3%

Eureka County

342

1

0.3%

Nye County

21,925

1

0.0%

Churchill County

7,180

0

0.0%

Esmeralda County

128

0

0.0%

Total

1,602,266

2,439

0.15%

Summary of Selected Findings – Nevada Home Insurance Wildfire Data Call – Expanded Version

Nevada Division of Insurance – Property and Casualty Advisory Committee Meeting of November 15, 2023

8

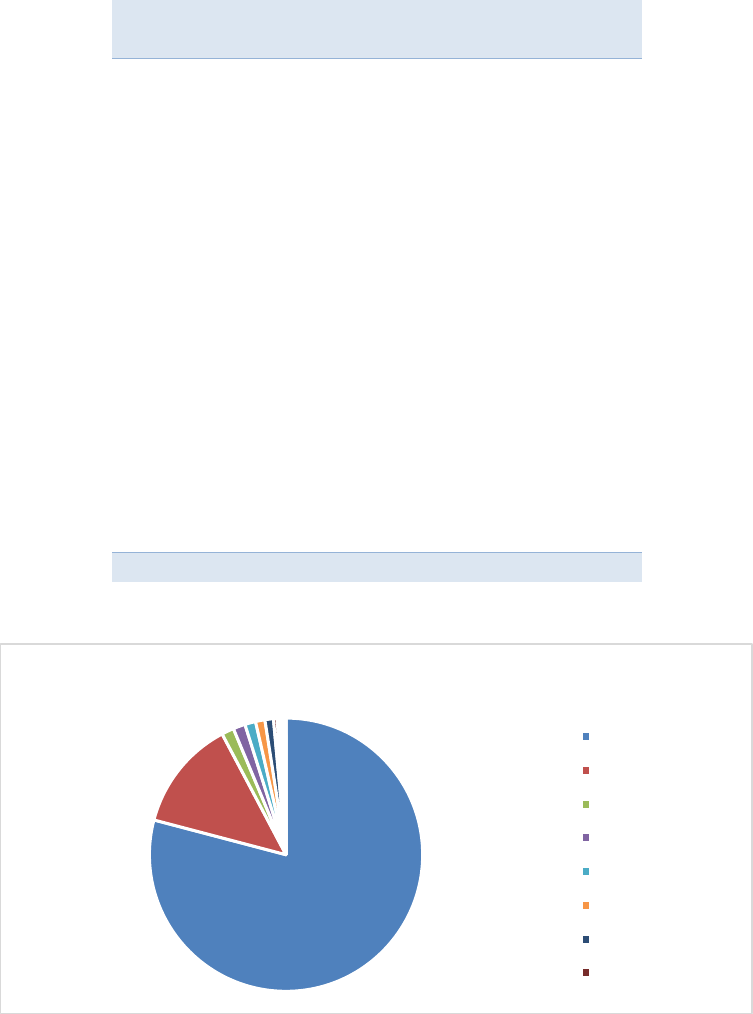

EXHIBIT 5

Home Insurance Cancellations or Non-Renewals by the Insurer in 2022 (For Any Reason)

County

Policies Cancelled or

Not Renewed

Clark County

91,248

Washoe County

15,181

Lyon County

1,677

Nye County

1,652

Carson City

1,471

Douglas County

1,281

Elko County

1,156

Churchill County

503

Humboldt County

392

White Pine County

274

Lander County

139

Lincoln County

125

Mineral County

122

Pershing County

64

Eureka County

37

Storey County

23

Esmeralda County

20

Grand Total

115,365

Total

Clark County

Washoe County

Lyon County

Nye County

Carson City

Douglas County

Elko County

Churchill County

Summary of Selected Findings – Nevada Home Insurance Wildfire Data Call – Expanded Version

Nevada Division of Insurance – Property and Casualty Advisory Committee Meeting of November 15, 2023

9

EXHIBIT 6

2022 Policies Cancelled or Non-Renewed by the Insurer Due to Wildfire Risk Concerns

County

Policies Cancelled

or Not Renewed

for Any Reason in

2022

Policies

Cancelled or

Not Renewed

Due to Wildfire

Risk Concerns

Policies Cancelled or Not

Renewed in 2022 Due to

Wildfire Risk Concerns, as

a Percentage of All Policies

Cancelled or Not Renewed

Washoe County

15,181

172

1.1%

Douglas County

1,281

59

4.6%

Elko County

1,156

14

1.2%

Clark County

91,248

7

0.0%

Lyon County

1,677

5

0.3%

Eureka County

37

2

5.4%

Lincoln County

125

2

1.6%

Carson City

1,471

2

0.1%

Nye County

1,652

2

0.1%

Churchill County

503

0

0.0%

Esmeralda County

20

0

0.0%

Humboldt County

392

0

0.0%

Lander County

139

0

0.0%

Mineral County

122

0

0.0%

Pershing County

64

0

0.0%

Storey County

23

0

0.0%

White Pine County

274

0

0.0%

Total

115,365

265

0.23%